FPCCI-SCC to collaborate

The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) President Atif Ikram Sheikh announced an intensified collaboration with the Scottish Chambers of Commerce (SCC) to actively promote trade, investments, joint ventures, and broader economic relations. Sheikh highlighted the robust Pakistani diaspora in Scotland, emphasising the substantial opportunity for expanding commercial and business interests. Dr. Jeanette Forbes, the Ambassador of Scottish Chambers for Pakistan,highlighted the […]

FPCCI-SCC to collaborate

The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) President Atif Ikram Sheikh announced an intensified collaboration with the Scottish Chambers of Commerce (SCC) to actively promote trade, investments, joint ventures, and broader economic relations. Sheikh highlighted the robust Pakistani diaspora in Scotland, emphasising the substantial opportunity for expanding commercial and business interests.

Dr. Jeanette Forbes, the Ambassador of Scottish Chambers for Pakistan,highlighted the MoU formalised on Sept 26, 2022 which aims to fortify trade cooperation but acknowledges the need for

additional efforts in export promotion, foreign direct investment,JVs, and B2B linkages.

Highlighting the significance of tourism, hospitality, and cultural avenues in Scotland, Forbes stressed their pivotal role in establishing robust people-to-people and B2B connections.

YEGAP Iran member wins at 3rd International Invention and Innovation Competition for IFIA Members

Sina Taghizadeh and Shadi Azimi Gohar, inventors from Iran, achieved success by winning the gold medal in a joint project titled “Device for Determining Temperament Based on Facial Recognition and Skin Color” at the 2023 International Federation of Inventors Associations (IFIA) competition held in Switzerland. Taghizadeh is a member of CACCI’s Young Entrepreneurs Group of Asia-Pacific (YEGAP). The World Invention Competition 2023 took place over […]

YEGAP Iran member wins at 3rd International Invention and Innovation Competition for IFIA Members

Sina Taghizadeh and Shadi Azimi Gohar, inventors from Iran, achieved success by winning the gold medal in a joint project titled “Device for Determining Temperament Based on Facial Recognition and Skin Color” at the 2023 International Federation of Inventors Associations (IFIA) competition held in Switzerland. Taghizadeh is a member of CACCI’s Young Entrepreneurs Group of Asia-Pacific (YEGAP).

Sina Taghizadeh and Shadi Azimi Gohar, inventors from Iran, achieved success by winning the gold medal in a joint project titled “Device for Determining Temperament Based on Facial Recognition and Skin Color” at the 2023 International Federation of Inventors Associations (IFIA) competition held in Switzerland. Taghizadeh is a member of CACCI’s Young Entrepreneurs Group of Asia-Pacific (YEGAP).

The World Invention Competition 2023 took place over three days (August 20th to 22nd) in Geneva, Switzerland, organized by the International Federation of Inventors Associations (IFIA). In this edition, inventors from various countries including the United States, Canada, England, Australia, Russia, China, Hong Kong, the United Arab Emirates, and Iran participated. Among all the participating countries, representatives from our country succeeded in winning the gold medal in this edition of the World Invention Competition.

Sina Taghizadeh, whose joint project with Shadi Azimi Gohar earned them the gold medal in this edition of the World Invention Competition, is also one of the young entrepreneurial managers in Iran. Taghizadeh stated that the International Federation of Inventors Associations (IFIA) holds invention registration events worldwide every year. These invention registrations are held in

various fields, and this year the third edition of the Federation’s competition was held in Geneva, Switzerland.

Taghizadeh continued: The Federation announces publicly in all countries and has offices in many countries, directly receiving projects and transferring them to Geneva, Switzerland. There,

the projects are judged, and this year, which was more vibrant than in previous years, participants from 36 countries including Canada, the United States, Australia, England, China, Russia, Hong Kong, and the United Arab Emirates, with 830 acceptable projects, were present.

The entrepreneur stated: Selected inventors submitted a short film of their innovation to participate in the festival, and the jury, considering criteria such as public demand, cost-effectiveness, environmental friendliness, etc., reviewed the submitted designs in 13 different categories.

Taghizadeh added that after the evaluation, the top performers in various categories are introduced to the world. He further added: “In the medical category, M.s Shadi Azimi Gohari and I were able to achieve the gold standard of this competition through our collaboration.”

Sina Taghizadeh continued: Our invention is in the field of Iranian traditional medicine and is titled “Temperament Diagnosis.” In traditional medicine, we diagnose diseases based on temperaments. We have four types of temperaments: warm and dry, warm and moist, cold and dry, cold and moist, which ancient Iranian traditional medicine says all diseases arise from these temperaments, and not adhering to the type of diet and lifestyle can affect these temperaments.

Our country’s inventor continued: Considering that doctors may make mistakes in diagnosing temperaments, we invented a device that, by examining and diagnosing the face and skin warmth and responding to a few short questions and some other signs with a high confidence level, diagnoses people’s temperaments, and based on that, provides a dietary plan to improve life, which

reduces the incidence of diseases in individuals. He said: We introduced this device as Iranian traditional medicine and it was accepted by the competition judges, and we were able to achieve

the gold medal in this competition for Iran.

IFIA is a non-governmental organization in the field of inventions and innovations, established in 1968 with the aim of creating an international platform to support inventors. IFIA’s mission is to foster the creation of knowledge, promote a culture of innovation, and facilitate the process of transforming ideas into wealth.

IFIA is a non-governmental organization in the field of inventions and innovations, established in 1968 with the aim of creating an international platform to support inventors. IFIA’s mission is to foster the creation of knowledge, promote a culture of innovation, and facilitate the process of transforming ideas into wealth.

The federation is a supervisory and advisory member of the United Nations Conference on Trade and Development (UNCTAD) and a member and observer of the European Patent Office (EPO).

It is the most important supporting organization for inventors worldwide, under the auspices of the World Intellectual Property Organization (WIPO), a member of the United Nations Industrial

Development Organization (UNIDO) and a special member of the European Union’s Innovation Union (EAI).

Sina Taghizadeh holds a PhD in Business Administration-Marketing from the University of Tehran. He is a professor at the University of Tehran, Vice President of the International Affairs and Trade Development Commission of the Iran house of Industry, Mine and Trade, a member of the International Federation of Inventors Associations, CEO of Afra Gol Caspian Company, and Chairman of the Board of Javid Toos Group of Companies. He is also the international deputy of the JCI Iran, Secretary and Founder of the International Youth Business Club (YBC), and

Ten Outstanding Young Persons of Iran in 2022 according to JCI Toyp.

Shadi Azimi Gohari holds a Master’s degree in Energy Architecture from the University of Tehran, Kish International Campus. She is also a Master of Entrepreneurship with a focus on New Business from the University of Tehran, Kish International Campus. She is a member of the Alborz Province Engineering Organization and holds a professional certificate in construction.

Iran News Agency

CACCI VP Dr. Alireza Yavari’s Business Dinner with Sri Lanka’s Foreign Minister Mr. Ali Sabri

On the evening of 5th August 2023, Dr. Alireza Yavari, the Vice-President of CACCI, attended a business dinner banquet planned by the Business Magnates Association (BMA) in Tehran. It was at this event that Dr. Yavari had the honor of engaging in a comprehensive discussion with the Foreign Minister of Sri Lanka, Mr. Ali Sabri. […]

CACCI VP Dr. Alireza Yavari’s Business Dinner with Sri Lanka’s Foreign Minister Mr. Ali Sabri

On the evening of 5th August 2023, Dr. Alireza Yavari, the Vice-President of CACCI, attended a business dinner banquet planned by the Business Magnates Association (BMA) in Tehran. It was at this event that Dr. Yavari had the honor of engaging in a comprehensive discussion with the Foreign Minister of Sri Lanka, Mr. Ali Sabri.

The crux of their conversation delved into the commercial activities prevalent in the APAC region.

The three primary topics discussed were:

- APAC Region Trade: The importance of commercial activities in the APAC region was highlighted, with an emphasis on enhancing trade relations among CACCI’s member states.

- Tourism in Sri Lanka: Focus was on Sri Lanka’s growing tourism sector, covering:

- The rise in foreign investments in hotels, especially luxury brands like Shangri-La.

- The involvement of Emirati investors in the hotel sector.

- The popularity of boutique hotels.

- Economic Strategy of Sri Lanka: Minister Sabri discussed:

- The nation’s success in reducing inflation from 70% to 6.7% swiftly.

- Steps taken included raising interest rates, removing subsidies, and introducing social security for the poorest 20%.

- These efforts led to Sri Lanka’s inclusion in the IMF program, reflecting economic stability and a confirmed $8 billion funding over four years from institutions such as the IMF and ADB, promising steady economic growth and recovery.

16th Singapore International Energy Week is Open – Register now!

Registration is now OPEN for the 16th Singapore International Energy Week (SIEW). Organised by the Energy Market Authority of Singapore (EMA), SIEW will take place from 23 to 27 October 2023 with the theme “Energy Transition Towards a Net Zero World”. SIEW 2023 will bring together energy ministers, leaders of global energy organisations and […]

16th Singapore International Energy Week is Open – Register now!

Registration is now OPEN for the 16th Singapore International Energy Week (SIEW). Organised by the Energy Market Authority of Singapore (EMA), SIEW will take place from 23 to 27 October 2023 with the theme “Energy Transition Towards a Net Zero World”.

SIEW 2023 will bring together energy ministers, leaders of global energy organisations and renowned industry experts, while providing a platform for panel discussions and networking opportunities where energy professionals can gain insights and forge new partnerships to address key energy issues. With a diverse line-up of renowned speakers and engaging sessions, SIEW offers an unparalleled platform for professionals to gain insights and exchange perspectives.

Global Energy Thought Leaders

Prominent industry leaders convening at SIEW 2023 include:

I. Governments and International Organisations

- H.E. Raphael Perpetuo Lotilla, Secretary of Energy, Republic of the Philippines

- Dr Akihiko Yokoyama, Chairman, Electricity and Gas Market Surveillance Commission (Japan)

- Eric Pang, Director, Electrical and Mechanical Services Department, Hong Kong SAR

- Dr Fatih Birol, Executive Director, International Energy Agency (IEA)

- Dr Marit Brommer, Executive Director, International Geothermal Association (IGA)

- Francesco La Camera, Director-General, International Renewable Energy Agency (IRENA)

- Mikhail Chudakov, Deputy Director General, International Atomic Energy Agency (IAEA)

- Dr Angela Wilkinson, Secretary General and Chief Executive Officer, World Energy Council

II. Industry

- Audra Low, Chief Executive Officer and Executive Director, Clifford Capital Pte Ltd

- James Stacey, Partner, Global Leader of Clients & Industries, ERM

- Eric Arnold, Executive Chairman, Global Energy Storage

- Toshiro Kudama, Chief Executive Officer, JERA Asia Pte. Ltd.

- Laura Ashton, Co-Founder and Chief Executive Officer, Low Carbon Advisors

- Takao Tsukui, Executive Vice President, International Sales and Marketing, Mitsubishi Power

- Shivkumar Kalyanaraman, Chief Technology Officer Energy Industry, Asia, Microsoft Asia Pacific

- Roberto Lorato, Director and Chief Executive Officer, PT Medco Energi Internasional Tbk

- Dannif Danusaputro, Chief Executive Officer, PT Pertamina Power Indonesia

- Paula Conboy, Board Member of PJM Interconnection and Senior Counsel, Sussex Strategy Group

- Martin Houston, Vice Chairman, Tellurian Inc

- Dilhan Pillay Sandrasegara, Executive Director and Chief Executive Officer, Temasek Holdings

- David Gray CBE, Non-Executive Director, Tokamak Energy

III. Anchor Events

SIEW 2023 will feature a range of anchor events organised by EMA. These include:

(1) SIEW Summit: This high-level event will bring together energy ministers, leaders of international organisations and industry experts to discuss topics such as: • Net Zero Asia

- Intensifying Net Zero Innovation

- Hydrogen as the Future of Net Zero Energy

- Securing Green Financing for a Net Zero Future

(2) Singapore-International Energy Agency (IEA) Forum: Co-hosted by Singapore and IEA, the forum will focus on the decarbonisation efforts in Southeast Asia towards Net Zero, and the policy levers required for a sustainable future.

(3) 3rd Singapore-International Renewable Energy Agency (IRENA) High-Level Forum: Co-hosted by Singapore and IRENA, the event will address the topics of “Pathways for Regional Interconnectivity” and “Scaling up Investment to accelerate Energy Transition”.

(4) SIEW Energy Insights, SIEW TechTable and SIEW Thinktank Roundtables: These industry events will facilitate knowledge exchange and discussions on emerging trends and innovations driving the region’s energy transition. China Renewable Energy Engineering Institute and Singapore Green Building Council will host the SIEW Thinktank Roundtables for the first time.

(5) The SIEW Energy Showcase: Returning for its second year, the Showcase will exhibit the latest industry trends, clean energy solutions, and sustainable practices driving Singapore’s and Asia’s net zero transition.

IV. Industry Events

SIEW 2023 will also play host to returning industry events across the energy domains:

Asia Clean Energy Summit (ACES): Commemorating its 10th edition, ACES will focus their discussions on the theme “Clean Energy for a Clean World”, featuring panels on solar and energy storage, electric mobility and energy efficiency for the low-carbon transition.

Asian Downstream Summit (ADS) & Asian Refining Technology Conference (ARTC): These events will address challenges across the downstream value chain, from green financing to cybersecurity. ADS also marks its 15th anniversary with a new discussion track focused on carbon capture, utilisation & storage.

Asia Hydrogen and LNG Markets Conference: The conference will explore pressing issues shaping the industry, such as shifting liquefied natural gas (LNG) trade flows and the viability of a hydrogen-powered economy.

Future of the Grid: The conference will deep dive into contemporary grid-related matters, with topics ranging from interconnectivity to renewables integration and grid modernisation. New this year, the event will host the inaugural ASEAN Energy Regulatory Forum, which will facilitate conversations between regulators, policy-makers and key industry stakeholders to enhance regional interconnectivity and facilitate the development of greener future grids.

Singapore skyline at night

Registration and More Information

With the opening of registration for SIEW 2023, early bird discounts are available. For more information on the conference programme, speakers, and bundled discounts available for partner events, please visit https://www.siew.gov.sg

About the Energy Market Authority

The Energy Market Authority (EMA) is a statutory board under the Singapore Ministry of Trade and Industry. Through our work, we seek to forge a progressive energy landscape for sustained growth. We aim to ensure a reliable and secure energy supply, promote effective competition in the energy market and develop a dynamic energy sector in Singapore. Visit www.ema.gov.sg for more information.

The Energy Market Authority (EMA) is a statutory board under the Singapore Ministry of Trade and Industry. Through our work, we seek to forge a progressive energy landscape for sustained growth. We aim to ensure a reliable and secure energy supply, promote effective competition in the energy market and develop a dynamic energy sector in Singapore. Visit www.ema.gov.sg for more information.

About Singapore International Energy Week

The Singapore International Energy Week (SIEW) is an official trademarked event by the Energy Market Authority (EMA). It is an annual platform for energy professionals,

The Singapore International Energy Week (SIEW) is an official trademarked event by the Energy Market Authority (EMA). It is an annual platform for energy professionals,

policymakers and commentators to discuss and share best practices and solutions within the global energy space. The 16th edition of SIEW will be held from the 23-27 October.

For media enquiries, please contact:

Mr Dion Lim

FINN Partners for Singapore International Energy Week

Tel: +65 6779 5514

Email: SIEWMedia@finnpartners.com

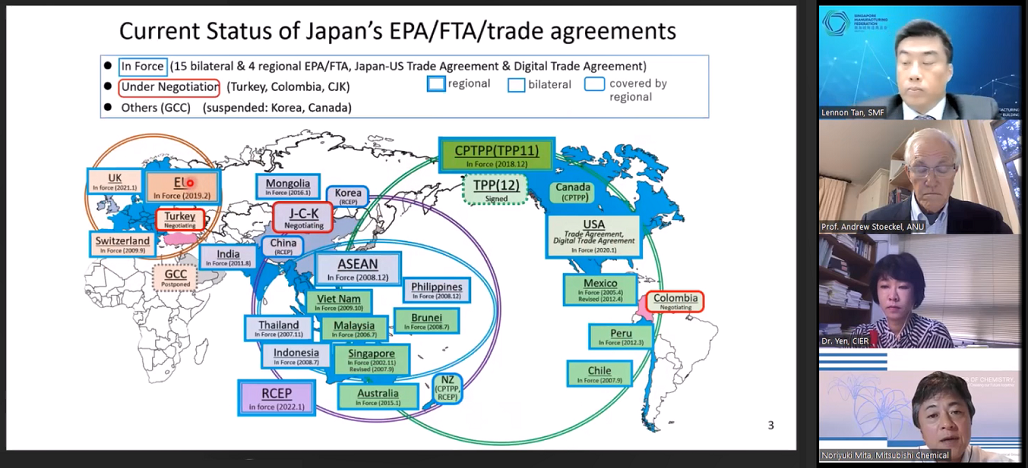

Experts discussed CPTPP Agreement during CACCI webinar

The Confederation of Asia-Pacific Chambers of Commerce and Industry (CACCI) organized a webinar on Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) on 28 June 2023. The 90-minute webinar discussion was moderated by Mr. Lennon Tan, President of the Singapore Manufacturing Federation, with Dr. Roy Chun Lee, Deputy Minister of Foreign Affairs, Republic of China (Taiwan) […]

Experts discussed CPTPP Agreement during CACCI webinar

The Confederation of Asia-Pacific Chambers of Commerce and Industry (CACCI) organized a webinar on Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) on 28 June 2023.

The 90-minute webinar discussion was moderated by Mr. Lennon Tan, President of the Singapore Manufacturing Federation, with Dr. Roy Chun Lee, Deputy Minister of Foreign Affairs, Republic of China (Taiwan) setting the introductory stage of the experts’ presentation of this difficult international trade agreement. The webinar featured three trade experts: (1) Mr. Noriyuki Mita, Director of Strategy & Planning Division at Basic Materials Business Group, Mitsubishi Chemical Corporation, (2) Dr. Huai-Shing Yen, Associate Research Fellow and Senior Deputy, Executive Director at the Taiwan WTO and RTA Center, Chung Hwa Institution for Economic Research (CIER), and (3) Hon. Professor Andrew Stoeckel, Centre for Applied Macroeconomic Analysis at the Australian National University.

Following their extensive presentation, the presenters engaged in a panel discussion to further elaborate on the issues affecting CPTPP, and concluded with a Q&A session. The summary of the webinar is presented as follows.

SUMMARY

(1) Mr. Lennon Tan, President of the Singapore Manufacturing Federation (Opening Remarks)

Mr. Lennon Tan commenced the webinar by welcoming all participants and setting the stage for the discussions. He emphasized the significance of collaboration among Asian economies to foster sustainable growth and innovation. Mr. Tan highlighted the pivotal role of manufacturing in driving economic development and the need for industries to adapt to evolving global trends.

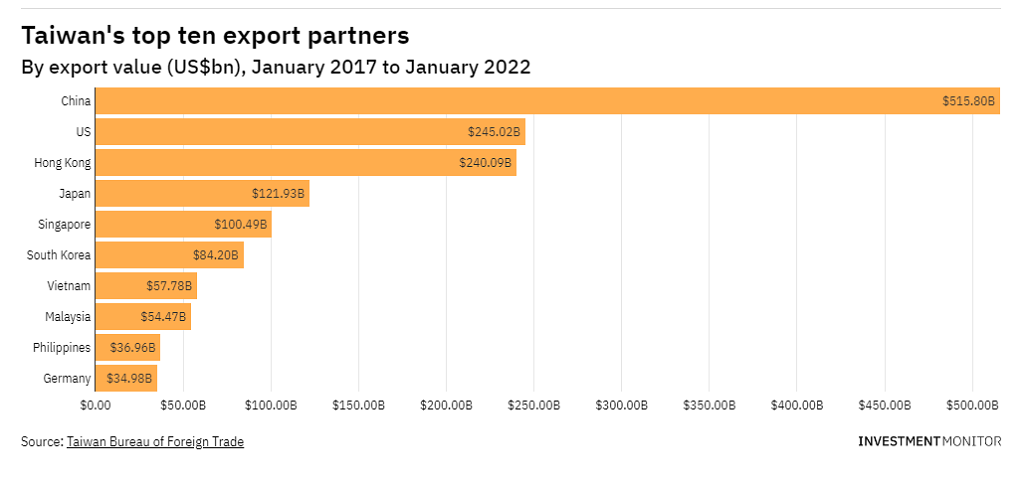

(2) Dr. Roy Chun Lee, Deputy Minister of Foreign Affairs, Republic of China (Taiwan) (Special Remarks)

Dr. Roy Chun Lee addressed the audience with insights into Taiwan’s foreign policy and economic strategies. He underscored Taiwan’s commitment to strengthening ties with neighboring countries and participating actively in regional trade agreements. Dr. Lee also discussed Taiwan’s initiatives in technology and innovation, aiming to position the nation as a leader in the global digital economy.

(3) Mr. Noriyuki Mita, Director of Strategy & Planning Division at Basic Materials Business Group, Mitsubishi Chemical Corporation (1st Presenter)

Mr. Noriyuki Mita presented on the advancements in sustainable materials and their applications in various industries. Key points from his presentation include:

- Sustainable Innovations: Introduction of eco-friendly materials developed by Mitsubishi Chemical Corporation to reduce environmental impact.

- Industry Applications: Examples of how these sustainable materials are being integrated into automotive and packaging sectors to promote circular economies.

- Future Outlook: Emphasis on continuous research and development to meet the growing demand for sustainable solutions globally.

(4) Dr. Huai-Shing Yen, Associate Research Fellow and Senior Deputy, Executive Director at the Taiwan WTO and RTA Center, Chung Hwa Institution for Economic Research (CIER) (2nd Presenter)

Dr. Huai-Shing Yen provided an analysis of regional trade agreements (RTAs) and their implications for Asian economies. Highlights from her presentation include:

- RTA Trends: Overview of the increasing number of RTAs in Asia and their role in facilitating trade and investment.

- Economic Impacts: Assessment of how RTAs contribute to economic growth, with a focus on tariff reductions and market access.

- Policy Recommendations: Suggestions for policymakers to maximize the benefits of RTAs, including aligning domestic regulations with international standards.

(5) Hon. Professor Andrew Stoeckel, Centre for Applied Macroeconomic Analysis at the Australian National University (3rd Presenter)

Professor Andrew Stoeckel discussed the macroeconomic challenges and opportunities facing the Asia-Pacific region. Key insights from his presentation include:

- Economic Outlook: Analysis of current economic indicators and growth projections for Asia-Pacific countries.

- Policy Challenges: Identification of issues such as income inequality and environmental sustainability that require coordinated policy responses.

- Strategic Opportunities: Exploration of areas where the region can capitalize on global trends, such as digitalization and green energy.

(6) Panel Discussion Summary

The webinar concluded with a panel discussion featuring all six participants. The key themes addressed during the discussion were:

- Regional Cooperation: The necessity for enhanced collaboration among Asian countries to tackle common challenges and leverage collective strengths.

- Innovation and Sustainability: The role of technological innovation in driving sustainable economic growth and addressing environmental concerns.

- Trade and Investment: Strategies to boost intra-regional trade and attract investment, including the harmonization of regulations and improvement of infrastructure.

Tehran, Tashkent Look to Boost Central Asian Cooperation

Wedged by Russia, China, Iran and Afghanistan, the Central Asian republics are pursuing multi-vector foreign policies to ensure economic growth and navigate among the local powers, as well as the US and Europe, even though the latter have antagonistic relations with the four countries. The republics know, “When the elephants fight, the grass suffers,” […]

Tehran, Tashkent Look to Boost Central Asian Cooperation

Wedged by Russia, China, Iran and Afghanistan, the Central Asian republics are pursuing multi-vector foreign policies to ensure economic growth and navigate among the local powers, as well as the US and Europe, even though the latter have antagonistic relations with the four countries.

The republics know, “When the elephants fight, the grass suffers,” reads an article published in OilPrice.come.

Uzbekistan is an example of the political entrepreneurship demanded of the republics, as they press ahead in an environment shaped by the twin shocks of the Taliban victory in Afghanistan and the NATO-Russia war in Ukraine.

In June 2023, Uzbek President Shavkat Mirziyoyev met Iran’s President Ebrahim Raisi and Iran’s Leader Ayatollah Ali Khamenei. The meeting netted cooperation pacts in areas as diverse as agriculture, energy, customs affairs, sports, science, technology and innovation, cultural exchanges, healthcare, Chabahar Port, the environment, industry and tourism. It was the first visit to Iran by an Uzbek leader in over 20 years.

The countries plan to increase annual trade to $3 billion, according to Raisi (trade was $431 million in 2021), and intend to develop a transport corridor through Turkmenistan, which Mirziyoyev first discussed with Turkmenistan’s President Serdar Berdimuhamedow in October 2022. (Transportation cooperation between Tashkent and Ashgabat started in 2017 with the opening of the Turkmenabat-Farab railroad and car bridges that will link the countries and open opportunities for long-distance trade.) Raisi pledged to connect Uzbekistan to high seas via Turkmenistan and Afghanistan.

The June meetings were a follow-up to the March 2023 visit by Uzbekistan’s foreign minister who met Iran’s ministers of foreign affairs and industries. Afterwards, the parties announced efforts to increase trade turnover, and foster business links and people-to-people ties. The ministerial meetings built on the September 2022 visit by Raisi to Uzbekistan that produced 17 agreements in areas such as energy, transport and agriculture, and discussed how to double trade from the current $500 million annually, though in less than a year the trade target has ambitiously increased to $3 billion.

Iran is increasingly attractive to the landlocked Central Asian republics that are seeking new trade routes. In June 2021, Tashkent hosted a conference to highlight Central Asia-South Asia connectivity via Afghanistan and Pakistan.

Two months later, the US and NATO retreated from Afghanistan and the country plunged in chaos, so the republics had to consider alternatives. In February 2022, the Russia-Ukraine war forced Kazakhstan to develop a trans-Caspian route to avoid the effects of the Russian-Ukraine war, and the other republics followed suit.

Central Asia can now consider trading through Iran’s ports of Chabahar and Bandar Abbas.

Iran can offer a space free of the violence by the Islamic State and the Pakistani Taliban that plagues Afghanistan and Pakistan; organized and functioning government agencies; and ports adjacent to the markets of India (Chabahar) and the Persian Gulf (Bandar Abbas). Iran is also a large market of close to 90 million people.

The US has promoted the Middle Corridor to the republics as an alternative to Iran, but avoiding the “Southern Corridor” via Iran or Afghanistan-Pakistan, deprives the republics of ready access to Asia and the Persian Gulf. The republics are not burdened by Washington’s sense of grievance against Iran that has festered since 1979, especially as there would be an economic cost of joining Washington’s campaign against the Islamic Republic, with no offsetting benefits other than a thank you for “doing the right thing.”

The republics want a reliable partner who can also help them deal with instability in Afghanistan. Iran shares that interest and has no territorial aspirations in Central Asia, though it will seek political support from the republics in fora such as the United Nations, as it implements its “Look East” policy and seeks a larger regional role through groups like the Shanghai Cooperation Organization.

The people of Tajikistan are Persian-speaking and many historic cities in the region, such as Samarkand and Bukhara in Uzbekistan, and Eastern Uzbekistan, are home to Tajik people who are indigenous to the region, so Iran will use cultural links, old and new, as tools of influence.

Financial Tribune

China, New Zealand willing to advance trade growth, agreements

China is willing to advance balanced trade growth with New Zealand and effectively implement the upgraded protocol of their free trade agreement, said the country’s top commerce official. During his meeting with Damien O’Connor, New Zealand’s Minister for Trade and Export Growth in Beijing, Chinese Commerce Minister Wang Wentao said China is keen to further […]

China, New Zealand willing to advance trade growth, agreements

China is willing to advance balanced trade growth with New Zealand and effectively implement the upgraded protocol of their free trade agreement, said the country’s top commerce official.

China is willing to advance balanced trade growth with New Zealand and effectively implement the upgraded protocol of their free trade agreement, said the country’s top commerce official.

During his meeting with Damien O’Connor, New Zealand’s Minister for Trade and Export Growth in Beijing, Chinese Commerce Minister Wang Wentao said China is keen to further strengthen exchanges and cooperation with New Zealand under frameworks such as the World Trade Organization, the Asia-Pacific Economic Cooperation, the Regional Comprehensive Economic Partnership, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, and the Digital Economy Partnership Agreement.

O’Connor said that New Zealand has maintained a long-standing and positive economic and trade cooperation with China

The two sides engaged in frank discussions, focusing on promoting bilateral economic and trade relations, as well as strengthening cooperation in regional and multilateral areas, said a statement released by China’s Ministry of Commerce after the meeting.

O’Connor said that New Zealand has maintained a long-standing and positive economic and trade cooperation with China. The trade structures of the two countries are highly complementary, and the bilateral free trade agreement has facilitated rapid growth in both export and import activities.

New Zealand will continue leveraging complementary advantages and strengthen cooperation with China, particularly in agriculture and food security sectors, said O’Connor, adding that the Oceania country seeks to enhance communication and coordination with China in multilateral and regional mechanisms.

Asia News Network

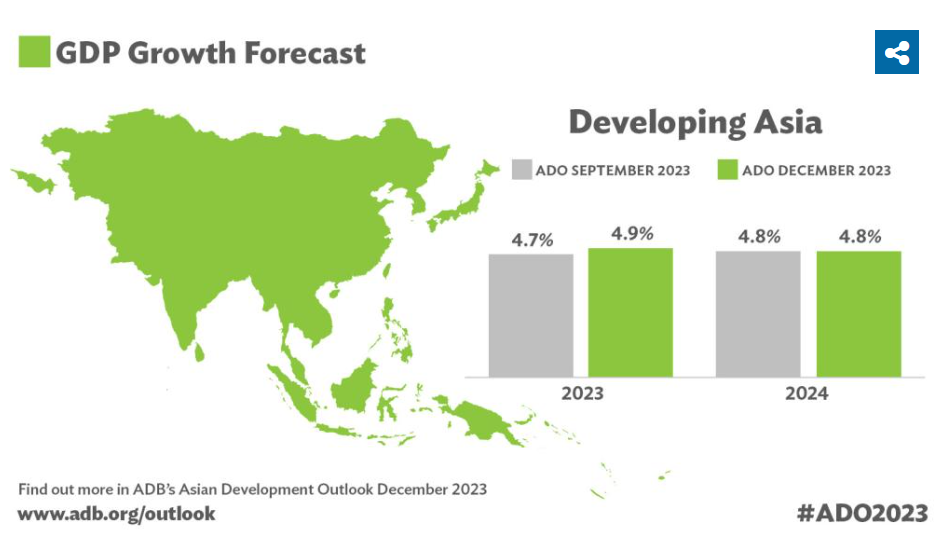

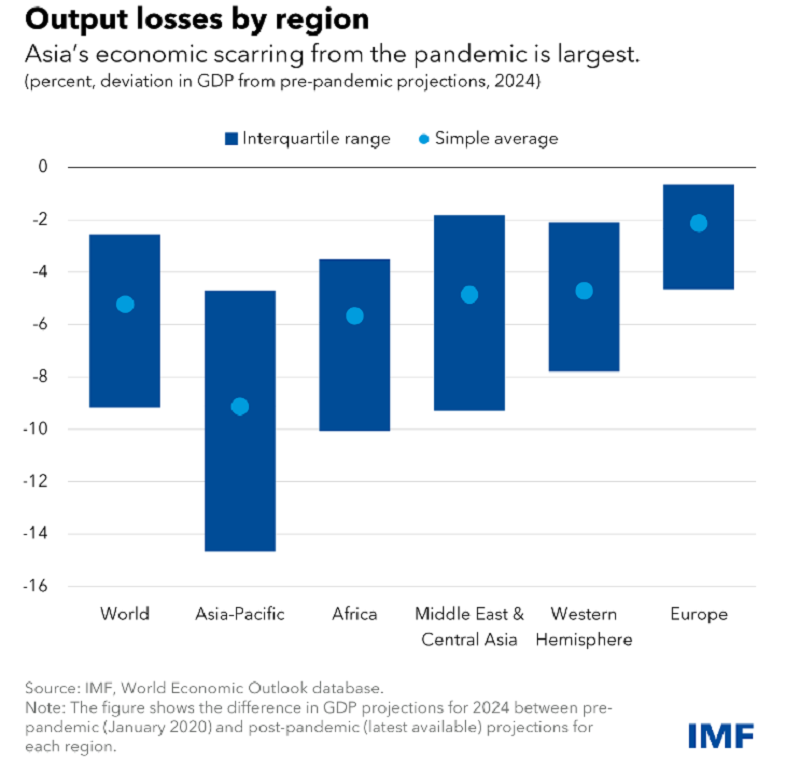

Developing Asia’s 2023 Growth Outlook Upgraded to 4.9%

The Asian Development Bank (ADB) has raised its economic forecast for developing economies in Asia and the Pacific, after robust domestic demand drove higher-than-expected growth in the People’s Republic of China (PRC) and India. The regional economy is expected to grow 4.9% this year, compared with a previous forecast of 4.7% in September, according to the Asian Development Outlook (ADO) December 2023. The […]

Developing Asia’s 2023 Growth Outlook Upgraded to 4.9%

The Asian Development Bank (ADB) has raised its economic forecast for developing economies in Asia and the Pacific, after robust domestic demand drove higher-than-expected growth in the People’s Republic of China (PRC) and India.

The regional economy is expected to grow 4.9% this year, compared with a previous forecast of 4.7% in September, according to the Asian Development Outlook (ADO) December 2023. The

outlook for next year is maintained at 4.8%. The PRC’s economy is projected to expand by 5.2% this year, compared with a previous forecast of 4.9%, after household consumption and public

investment boosted growth in the third quarter.

The growth outlook for India has been raised to 6.7% from 6.3% following faster-than-expected expansion in July-September, driven by double-digit growth in industry. The upgrades for the PRC and India more than offset a lowering of the forecast for Southeast Asia, caused by lackluster performance in the manufacturing sector.

“Developing Asia continues to grow at a robust pace, despite a challenging global environment,” said ADB Chief Economist Albert Park. “Inflation in the region is also gradually coming under control. Still, risks remain, from elevated global interest rates to climate events such as El Niño. Governments in Asia and the Pacific need to remain vigilant to ensure that their economies are resilient, and that growth is sustainable.”

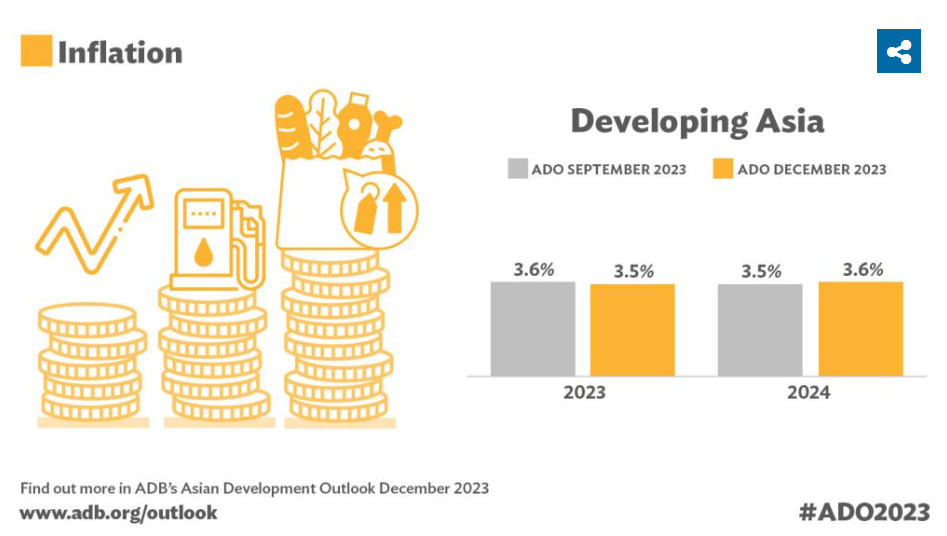

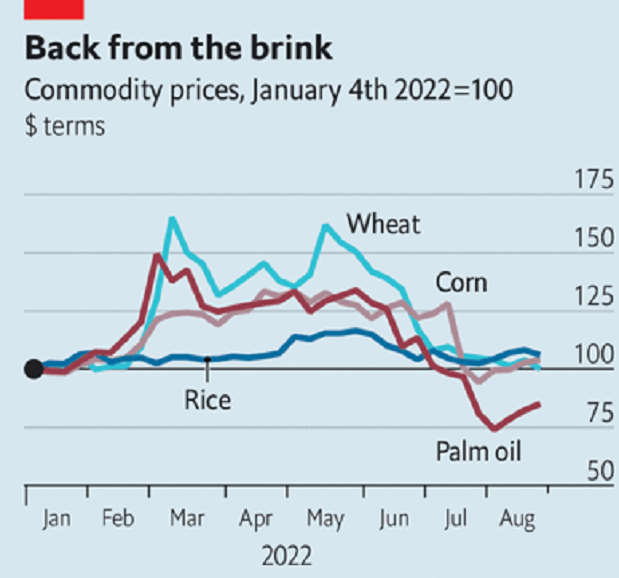

The region’s inflation outlook for this year has been lowered to 3.5% from an earlier projection of 3.6%, according to ADO December 2023. For next year, inflation is expected to edge up to 3.6%,

compared with a previous forecast of 3.5%. The growth outlook for Southeast Asia this year has been lowered to 4.3% from 4.6%, amid weak demand for manufacturing exports. The outlook for economies in the Caucasus and Central Asia has been raised slightly, while projections for Pacific economies are unchanged.

Risks to the outlook include persistently elevated interest rates in the United States and other advanced economies, which could contribute to financial instability in vulnerable economies

in the region, especially those with high debt. Potential supply disruptions caused by the El Niño weather pattern or the Russian invasion of Ukraine could also rekindle inflation, particularly regarding food and energy.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned

by 68 members—49 from the region.

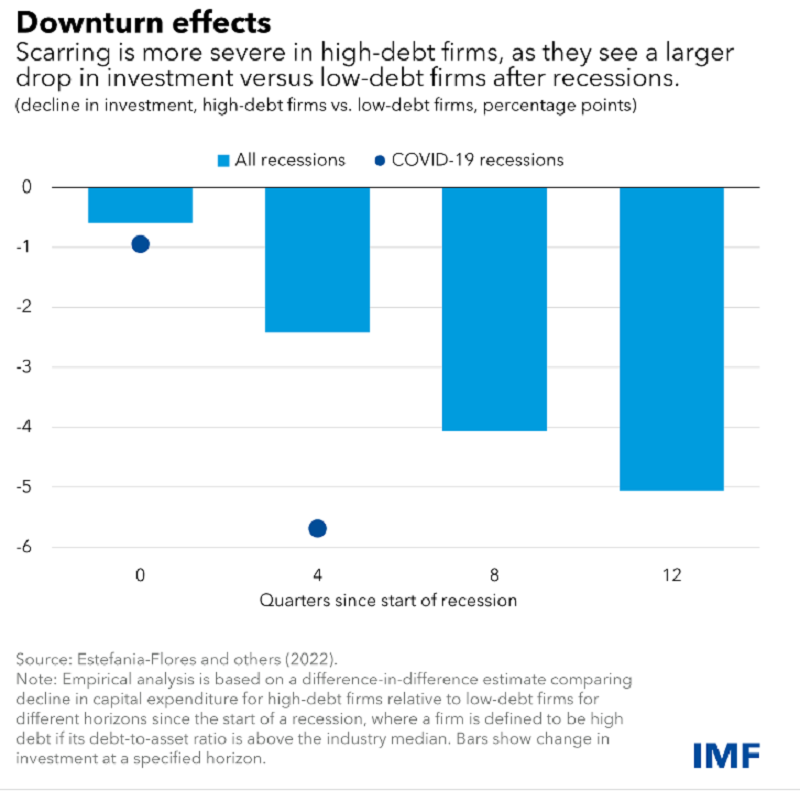

Inflation retreat will bring some comfort to small business: ACCI

Fresh inflation numbers will offer some consolation to Australia’s 2.4 million small business owners, many of whom are nearing breaking point as price pressures and elevated interest rates increase the risk of further economic pain. “After experiencing 12 interest rate increases, declining consumer spending, and a surge in input costs, it’s good news for small […]

Inflation retreat will bring some comfort to small business: ACCI

Fresh inflation numbers will offer some consolation to Australia’s 2.4 million small business owners, many of whom are nearing breaking point as price pressures and elevated interest rates increase the risk of further economic pain.

Fresh inflation numbers will offer some consolation to Australia’s 2.4 million small business owners, many of whom are nearing breaking point as price pressures and elevated interest rates increase the risk of further economic pain.

“After experiencing 12 interest rate increases, declining consumer spending, and a surge in input costs, it’s good news for small businesses that inflation is returning to its downward trend,” ACCI chief of policy and advocacy David Alexander said.

“As supply chain bottlenecks ease, small businesses have experienced a decline in petrol prices while material costs have also steadily decreased from previously high levels.

“Despite this welcome progress, the expected inflation-chasing wages hike from July 1 will heap even more pressure on small businesses when they can least afford it.

“Many small businesses are seeing their costs rise to the point where they have no choice but to increase their prices to maintain operations.

“With further disruption on the horizon as the federal government pursues retrograde changes to the industrial relations system, small businesses across the country are questioning why laws that will make it harder to create new jobs and grow the economy are needed.

“At its meeting next week, the Reserve Bank should take stock of whether rates are sufficiently restrictive to bring inflation back to target.

ACCI Newsroom

CNAIC elects Thomas Wu as new Chairman

The Chinese National Association of Industry and Commerce (CNAIC) held a general meeting on June 21, 2022, during which they elected Thomas T.L. Wu as their 26th-term Chairman. Wu’s term was effective immediately following the election. He takes over the role from former Chairman Por-Fong Lin. According to Wu, he plans on leading CNAIC to […]

CNAIC elects Thomas Wu as new Chairman

The Chinese National Association of Industry and Commerce (CNAIC) held a general meeting on June 21, 2022, during which they elected Thomas T.L. Wu as their 26th-term Chairman. Wu’s term was effective immediately following the election. He takes over the role from former Chairman Por-Fong Lin.

The Chinese National Association of Industry and Commerce (CNAIC) held a general meeting on June 21, 2022, during which they elected Thomas T.L. Wu as their 26th-term Chairman. Wu’s term was effective immediately following the election. He takes over the role from former Chairman Por-Fong Lin.

According to Wu, he plans on leading CNAIC to become a more influential platform that speaks for the industry, to assist the industry and commerce communities in communicating with the government and connect them to the world, and to ultimately promote Taiwan’s economic growth and development. To achieve this, he will use four core principles: optimizing the investment and operation environment; deepening global economic cooperation; promoting the innovative use of energy in industry and commerce; and planning for a sustainable future.

Apart from his new role as Chairman of CNAIC, Wu is also concurrently Chairman of Taishin Financial Holdings, Taishin Bank, and Taishin Charity Foundation.

His experience in both the industrial and financial sectors is vast. He was the Chairman and President of Shinkong Synthetic Fibers Corporation; the Vice Chairman of TECO Electric and Machinery; and the Director, Managing Director and Supervisor of First Bank, Taipei Business Bank, and Hua Nan Bank respectively. In 1992, he co-founded Taishin Bank with societal leaders and established Taishin Financial Holdings in 2002. Since then, the business scope of Taishin Financial Holdings has expanded to include banking, life insurance, securities, investment trust, investment advisory, leasing, and asset management.

Wu is also deeply aware of his social responsibilities. He has served as the Chairman of Friends of the Police Association and is the current convener for their Board of Supervisors. At the same time, he is Managing Director of both the Taiwan After-Care Association and the Association for Victims Support.

First board of directors meeting of FBCCI Innovation, Research Centre held

The FBCCI Innovation and Research Center, a pioneering venture initiated by FBCCI, held its inaugural board of directors meeting on June 21, 2023 at a hotel in the capital. The Initiative aimed to address the challenges of the fourth industrial revolution and foster growth in the private sector through research and policy support. Salman F Rahman, […]

First board of directors meeting of FBCCI Innovation, Research Centre held

The FBCCI Innovation and Research Center, a pioneering venture initiated by FBCCI, held its inaugural board of directors meeting on June 21, 2023 at a hotel in the capital. The Initiative aimed to address the challenges of the fourth industrial revolution and foster growth in the private sector through research and policy support.

Salman F Rahman, Prime Minister’s Private Industry and Investment Adviser, attended the meeting as the chief guest. He emphasized the timely significance of the Innovation and Research Center in the current business landscape and highlighted its pivotal role in advancing the country’s development by empowering the private sector through research-driven policies, said a press release today.

The Chairman of the Board of Directors of the FBCCI Innovation and Research Centre and FBCCI President Md Jashim Uddin presided over the meeting. Md Jashim Uddin expressed his confidence that the FBCCI Innovation and Research Center would accelerate the ongoing progress of the nation, led by Prime Minister Sheikh Hasina.

He further emphasized the institution’s vital contribution to propelling the private sector forward and thus providing essential policy support through robust research initiatives. During the meeting, the board of directors finalized the draft of the proposed Memorandum of Association and Rules & Regulations.

Business Post

FNCCI proposes BIMSTEC Business Forum to boost intra-regional trade

The Federation of Nepalese Chambers of Commerce and Industries (FNCCI) President Chandra Prasad Dhakal floated the idea for the formation of the BIMSTEC Business Forum to boost intra-region trade and investments in the member countries among their private sector. Speaking at the Special Plenary Session of the International Trade Forum during the Bay of Bengal […]

FNCCI proposes BIMSTEC Business Forum to boost intra-regional trade

The Federation of Nepalese Chambers of Commerce and Industries (FNCCI) President Chandra Prasad Dhakal floated the idea for the formation of the BIMSTEC Business Forum to boost intra-region trade and investments in the member countries among their private sector.

Speaking at the Special Plenary Session of the International Trade Forum during the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) Business Conclave in Calcutta, India, President Dhakal said as the private sector is involved in trade and investment, the formation of a business forum would achieve commercial success.

He further said that to foster regional trade and investments, there is a need for an efficient and effective infrastructure such as land, waterway, rail, air and digital connectivity.

“We need to jointly invest to improve the existing connectivity infrastructure and also build new ones for better connectivity.”

Similarly, enhancing physical infrastructure, such as roads, ports, and logistics facilities was essential for the efficient movement of goods within the region, he said, adding, joint efforts could be made to develop and upgrade infrastructure to support the development of regional value chains.

“Promoting cross-border energy cooperation, including the development of energy infrastructure and efficient energy trade can support the growth of energy-intensive industries within the regional value chains.

For example, Nepal- Bangladesh and India have been working on hydropower transmission lines, to export electricity produced in Nepal, to Bangladesh, via India. “The success of such a project can be expanded to other BIMSTEC nations and beyond as well,” Dhakal said.

In addition to connectivity infrastructure, BIMSTEC countries need to remove and reduce the various non-tariff barriers for trade, making the regional trade and investments smooth.

BIMSTEC nations can work towards aligning their trade and investment policies to create a conducive environment for regional value chains. “This can involve streamlining customs procedures, simplifying regulations and promoting investment facilitation measures,” said Dhakal.

He added: “The free trading arrangement in the region can facilitate increased bilateral and multilateral trade among the member countries. Nepal can benefit from the removal or reduction of tariffs for its exports, leading to a boost in trade volumes and diversification of its export base.”

Dhakal said the regional connectivity and free trade agreements would also help attract foreign direct investments (FDI).

“Smooth and strong regional connectivity and free trade arrangement will help attract FDI. Improved market access and reduced trade barriers will encourage foreign companies to invest in various sectors of the economy, leading to economic growth and job creation in the BIMSTEC countries,” he added.

The share of all BIMSTEC countries — that include two ASEAN member-states – Thailand and Myanmar — is less than 4 percent in world trade.

The BIMSTEC intra-regional trade was at $70 billion in 2021, significantly lower than ASEAN’s $600 billion.

The BIMSTEC members have agreed to establish the BIMSTEC Free Trade Area Framework Agreement in order to stimulate trade and investments. BIMSTEC countries’ existing trade and investment profiles are overwhelmingly influenced by their levels of economic development, geographical proximity, cross-border logistic facilities and different regional cooperation agreements.

Kathmandu Post

PCCI backs land reform debt write off

The Philippine Chamber of Commerce and Industry (PCCI) said it is backing the enactment of a proposed law that will condone some P57 billion in debt incurred by land reform beneficiaries, signaling strong support from the private sector for a measure that is currently awaiting approval by President Marcos. “The New Agrarian Emancipation Act is […]

PCCI backs land reform debt write off

The Philippine Chamber of Commerce and Industry (PCCI) said it is backing the enactment of a proposed law that will condone some P57 billion in debt incurred by land reform beneficiaries, signaling strong support from the private sector for a measure that is currently awaiting approval by President Marcos.

The Philippine Chamber of Commerce and Industry (PCCI) said it is backing the enactment of a proposed law that will condone some P57 billion in debt incurred by land reform beneficiaries, signaling strong support from the private sector for a measure that is currently awaiting approval by President Marcos.

“The New Agrarian Emancipation Act is expected to provide much-needed financial relief to the agricultural reform beneficiaries to allow farmers freed from debt to devote more resources to their land,” PCCI president George Barcelon, whose business association touts itself as the largest in the country, said in an online forum.

“Hopefully, the enactment of this measure will help in the development of farms, increase productivity and advance an agriculture-driven economy,” he added.

Barcelon also noted that the weakest link in Philippine socioeconomic development is agriculture, adding that it has continued to decline in terms of contribution to the country’s overall economic output which is now pegged at around 9 percent.

The PCCI official cited that the services sector has expanded significantly, contributing 61 percent, while the industry sector has a share of 30 percent.

According to the Philippine Statistics Authority, the agriculture, forestry and fishing sector accounted for only 8.9 percent of the Philippines’ gross domestic product (GDP) in 2022, the lowest in five years.

“Putting this into perspective, agriculture accounted for one-quarter of the country’s GDP during the 1980s and almost one-third in the 1970s. We were a net exporter of agricultural products in the 1980s but as of the 1990s, we have become net importers as exports fell behind, outpaced by imports,” Barcelon said, but noted that the sector still provides employment for 25 percent of the country’s labor force.

Barcelon pointed out that restrictions under the Comprehensive Agrarian Reform Law have put farmers in grave states of indebtedness through the erosion of the value of their lands, limited access to credit and constrained the transfer of land to more productive uses, among others.

The Partido Federal ng Pilipinas, which is led by President Marcos as national chair, had recently cited the benefits of letting the chief executive continue to lead the Department of Agriculture.

“This is because the President knows what to do and apparently has the solutions needed to address problems in the agriculture sector,” South Cotabato Gov. Reynaldo Sucayan Tamayo Jr., who stands as the party president, said last week.

Philippine Daily Inquirer

Singapore Manufacturing Federation appoints CEO and CSO

The Singapore Manufacturing Federation (SMF) said on May 25 that it has appointed Dennis Mark as it chief executive officer effective Jun 15. The federation said in a statement that it has re-designated the position of secretary-general to CEO. SMF’s website shows that the role of secretary-general is vacant. The position was previously occupied by […]

Singapore Manufacturing Federation appoints CEO and CSO

The Singapore Manufacturing Federation (SMF) said on May 25 that it has appointed Dennis Mark as it chief executive officer effective Jun 15.

The Singapore Manufacturing Federation (SMF) said on May 25 that it has appointed Dennis Mark as it chief executive officer effective Jun 15.

The federation said in a statement that it has re-designated the position of secretary-general to CEO. SMF’s website shows that the role of secretary-general is vacant. The position was previously occupied by Lawrence Pek.

SMF said Mark has more than 20 years of experience in the manufacturing sector in multinational corporations under the HP group.

The federation also announced that it has appointed Clement Teo as its first chief sustainability officer (CSO) and assistant chief executive effective Jun 5. SMF said Teo has led sales and operational teams across the Asean region in TUV-SUD, an organisation in the testing, inspection and certification industry.

SMF president Lennon Tan said the new appointments will “bring a new focus on new ideas to bring new benefits to SMF members”.

“The appointment of SMF’s first CSO will also add expertise to the SMF in an area which manufacturers large and small will require to remain competitive in the global arena,” he said.

The Business Times

Kazakhstan and Singapore Create Joint Venture to Promote Trans-Caspian International Transport Route

Kazakhstan Temir Zholy (KTZ) national railway company and PSA International, a leading port group with a global network, signed an agreement to establish a joint venture to develop Kazakhstan’s transport and transit potential by promoting the Trans-Caspian International Transport Route (TITR) and enhancing connectivity and trade flows from Southeast Asia and China to Europe […]

Kazakhstan and Singapore Create Joint Venture to Promote Trans-Caspian International Transport Route

Kazakhstan Temir Zholy (KTZ) national railway company and PSA International, a leading port group with a global network, signed an agreement to establish a joint venture to develop Kazakhstan’s transport and transit potential by promoting the Trans-Caspian International Transport Route (TITR) and enhancing connectivity and trade flows from Southeast Asia and China to Europe through Kazakhstan.

The agreement was signed during a May 22 Kazakhstan-Singapore Business Forum as part of President of Singapore Halimah Yacob’s first visit to Central Asia, reported KTZ on May 23.

“This joint venture is a milestone moment for PSA, as it expands our global footprint into Central Asia and reflects our continued commitment to enhance global connectivity and enable sustainable trade,” said Tan Chong Meng, Group CEO of PSA International.

KTZ said the experience and technologies of PSA will open up additional opportunities to expand transportation geography and integrate Kazakh transport corridors with the world’s largest hubs.

According to the PSA leadership, relevant experience and pooled resources will help create an efficient logistics network connecting countries and continents. This will allow KTZ to enter new markets and establish itself as a key player in the global logistics arena.

Business leaders from Kazakhstan and Singapore signed commercial documents worth $275 million at the Kazakhstan-Singapore forum.

Astana Times

Kadin holds expo to engage Chinese firms in smart city development

The Indonesian Chamber of Commerce and Industry (Kadin) – China Committee (KIKT) has organized the Indonesia-China Smart City Technology & Investment Expo 2023 to encourage Chinese companies to participate in smart city development in Indonesia. “This event is expected to provide information about the development of smart cities and (the new capital) IKN Nusantara for stakeholders to invest in the country […]

Kadin holds expo to engage Chinese firms in smart city development

The Indonesian Chamber of Commerce and Industry (Kadin) – China Committee (KIKT) has organized the Indonesia-China Smart City Technology & Investment Expo 2023 to encourage Chinese

companies to participate in smart city development in Indonesia.

“This event is expected to provide information about the development of smart cities and (the new capital) IKN Nusantara for stakeholders to invest in the country and open opportunities for local

industry players in the international market,” Head of the Expo’s Committee Ben Yura Rimba said.

He said that the expo, which is being held in collaboration with the Chinese Indonesian Association (INTI), aims to accelerate government programs in 100 smart cities and IKN Nusantara’s

development.

Around 50 high-tech manufacturing companies, mostly from Guangdong province, China, are participating in the expo, which is taking place from May 24–26, 2023. These companies could help implement advanced concepts and technologies in the construction of smart cities, Rimba said.

“Some of the companies have carried out their businesses in Indonesia for many years, with the confidence that Indonesia is a promising market. This expo is a bridge for the companies to step onto the world stage,” he added.

Meanwhile, KIKT chairperson Garibaldi Thohir said he expects the event to serve as a forum for exchanging information and carrying out education and promotion as well as exploring opportunities to find the best partners for smart city development in Indonesia

“We invite companies engaged in smart city development, especially companies from China that have experience in the development of Internet- based digital technology and innovation, which is the backbone of smart city development,” he added. INTI chairperson Teddy Sugianto stated that smart city development will be a future trend in Indonesian cities.

“As a national organization, INTI remains loyal and committed to helping the recovery and revival of the national economy post-pandemic. We hope that this event can be a driving factor for investment in Indonesia,” he added.

Amtara News

Taiwan eases hiring rules to bring in 28,000 more migrant workers

Taiwan will ease employment regulations to allow for the entry of 28,000 additional migrant workers as soon as mid-June to address its worker shortage. On May 23, the Ministry of Labor (MOL) announced it will relax regulations employing migrant workers in the following industries: manufacturing, construction, agriculture, and caregiving. The sectors will be allotted […]

Taiwan eases hiring rules to bring in 28,000 more migrant workers

Taiwan will ease employment regulations to allow for the entry of 28,000 additional migrant workers as soon as mid-June to address its worker shortage.

On May 23, the Ministry of Labor (MOL) announced it will relax regulations employing migrant workers in the following industries: manufacturing, construction, agriculture, and caregiving. The sectors will be allotted 600, 8,000, 12,000, and 14,000 extra workers, respectively.

The “notice period” for adjusting the qualifications for hiring migrant workers will last until May 30.

In the manufacturing industry, there will be 210 companies eligible for the relaxed rules, including 142 aquatic product processing companies, 37 tofu manufacturing firms, and 31 shipbuilders. The MOL plans to increase the allocation ratio of foreign migrant workers from 15% to 20%.

For the construction industry, the new rules will be applied to construction businesses, professional construction companies, and civil engineering contractors that have handled a minimum number of cases and Taiwanese workers over the past three years. These companies can hire migrant workers at a ratio of 30%, and the employment stability fee could increase that number to 40%.

For the agricultural sector, the number of incoming migrant workers will increase from 6,000 to 12,000. This will increase the ratio of migrant workers to local workers employed by individual farmers or small-sized farming operators with less than 10 people from 35% to 50%. The 35% ratio would remain the same for public institutions and large-scale farmers.

As for caregiving, an additional 14,000 workers will be hired. The ratios of one caregiver per three residents in social welfare institutions, one caregiver per five residents at long-term care facilities, and one caregiver per care recipient for live-in caregiving will not change.

Taiwan News

New ICCIMA President Elected

Hossein Selahvarzi has been elected the new head of Iran Chamber of Commerce, Industries, Mines and Agriculture. He will be at the helm of the chamber for the next four years, replacing Gholamhossein Shafei. The election of the new president came after a March vote for new members. “The government had no intervention in the process […]

New ICCIMA President Elected

Hossein Selahvarzi has been elected the new head of Iran Chamber of Commerce, Industries, Mines and Agriculture. He will be at the helm of the chamber for the next four years, replacing Gholamhossein Shafei. The election of the new president came after a March vote for new members. “The government had no intervention in the process of election,” Selahvarzi was quoted as saying by IRNA.

At a press conference following his election, he noted that transparency will be top the agenda of ICCIMA under his leadership and the chamber’s organizational structure should be reformed. Selahvarzi underlined the importance of re-inviting European businesses after their pullback from the Iranian market as a result of the US sanctions. ICCIMA, known as “private sector parliament” is a 140-year-old institution and represents Iran’s private businesses.

Describing chambers of commerce as “the only honest observers” of policymaking developments and economic trends in Iran, Mohsen Jalalpour, former president of ICCIMA, said despite all the criticisms leveled at them, they can play a key role in making correct economic decisions and sending important signals from the private sector to the policymaking system.

“The estimates and analyses of the chambers of commerce are vital, if decision-makers are willing to design a win-win game for all economic players. The point is that the representatives of this large organization are members of different manufacturing, commercial, industrial and mining sectors. Contrary to what is believed, the members of the chamber are not from a specific trade and do not have common interests. Therefore, if competent people make up the chamber’s board, they can be vigilant watchers for the country’s business environment and work to consolidate important economic concepts such as competition and ownership,” he wrote for the Persian economic daily Donya-e-Eqtesad.

Jalalpour believes the main mission of the chamber is monitoring the business environment and not bargaining to gain more privileges and benefits.

“The leading members of the chambers should be the voice of the real private sector that does not seek to acquire wealth through privileges and rent-seeking practices. Therefore, the representative of the chamber should have the ability to distinguish between decent demands from rent-seeking demands,” he said.

Financial Tribune

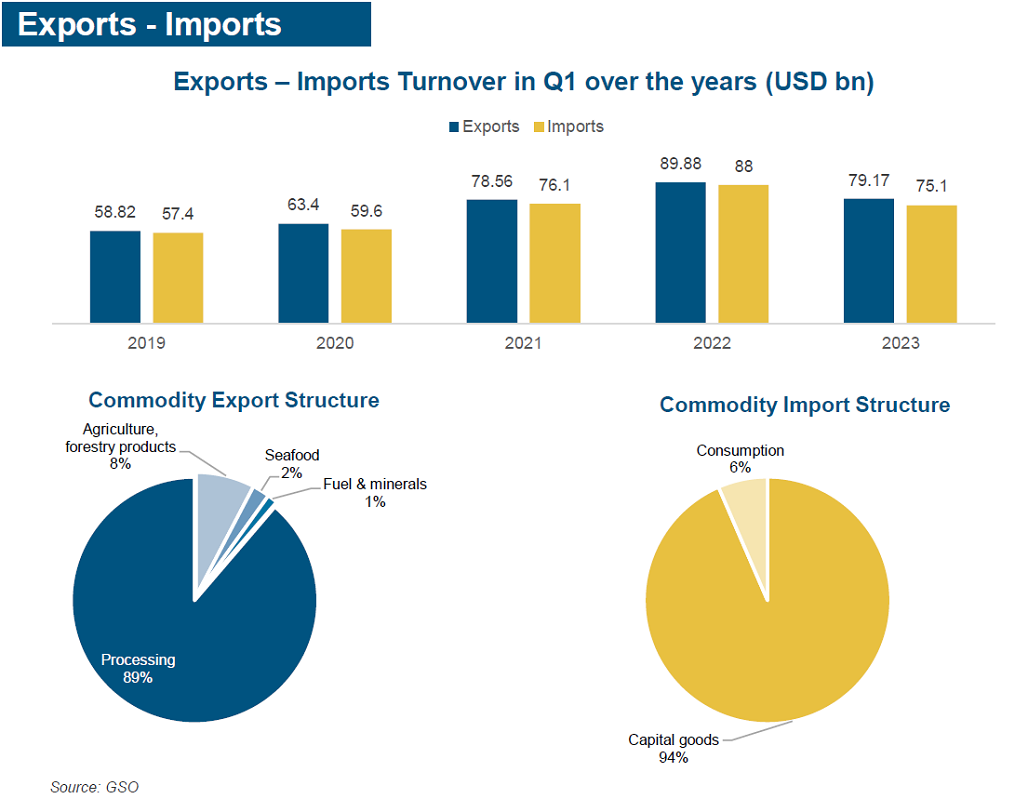

VietNam Business Update – Special Edition

In April 2023, the VietNam Chamber of Commerce and Industry (VCCI) produced the Vietnam Business Update – Special Edition publication in celebration of its 60th anniversary. The publication showcase VietNam’s remarkable progress over the past and wish to present to you the vast and diversified business opportunities that VietNam offers to its foreign friends. VCCI […]

VietNam Business Update – Special Edition

In April 2023, the VietNam Chamber of Commerce and Industry (VCCI) produced the Vietnam Business Update – Special Edition publication in celebration of its 60th anniversary.

In April 2023, the VietNam Chamber of Commerce and Industry (VCCI) produced the Vietnam Business Update – Special Edition publication in celebration of its 60th anniversary.

The publication showcase VietNam’s remarkable progress over the past and wish to present to you the vast and diversified business opportunities that VietNam offers to its foreign friends.

VCCI has been a leading advocate for business development trade promotion, and economic cooperation in VietNam for six decades. Since our establishment in 1963, we have worked tirelessly to create a conducive business environment, promote entrepreneurship, and support the growth of VietNam’s private sector.

Today, VCCI proudly owns the membership network of over 200,000 companies and over 200 business associations across all sectors of the economy, and we continue to expand our reach beyond boundaries.

As VietNam continues integrating more deeply into the global economy, VCCI recognizes the importance of engaging with foreign partners to foster cooperation, share knowledge, and promote mutual understanding.

In fact, foreign partnerships have been instrumental in promoting trade and investment, building networks of contacts, and opening up new opportunities for businesses in VietNam and abroad.

Please take a look at the publication HERE.

Asia-Pacific business leaders call for forging a new path on inclusion, resilience, and sustainability

APEC Business Advisory Council (ABAC) members this week urged APEC Trade Ministers to leverage the challenges facing the region, including environmental risks, financial stress and the cost-of-living crisis, as opportunities to firmly place the region on a new path of economic inclusion, resilience, and sustainability. Separate letters to APEC trade ministers and transportation ministers […]

Asia-Pacific business leaders call for forging a new path on inclusion, resilience, and sustainability

APEC Business Advisory Council (ABAC) members this week urged APEC Trade Ministers to leverage the challenges facing the region, including environmental risks, financial stress and the cost-of-living crisis, as opportunities to firmly place the region on a new path of economic inclusion, resilience, and sustainability. Separate letters to APEC trade ministers and transportation ministers and statements on the WTO and the Free Trade Area of the Asia-Pacific capture ABAC’s views.

2023 ABAC Chair Dominic Ng noted, “The private sector wants to see governments in the region build on the lessons learned from dealing with the pandemic to make trade more resilient, inclusive, and sustainable for all. ABAC is supporting this effort by bringing forward clear, concrete recommendations for governments that, if implemented, will result in tangible outcomes. Many of these recommendations are captured in the letters and statements that we finalized at our meeting in Brunei.”

Regarding ABAC’s Statement on the World Trade Organization, Ng said, “Our businesses, communities and our planet deserve a future-ready, effective, and enforceable global trading system – that demands ambitious outcomes at the WTO, including on core reforms in agriculture, fisheries subsides and dispute settlement, and in the open plurilateral negotiations on digital trade and the environment.”

ABAC’s separate Statement on the FTAAP calls for well-designed and modern trade rules in the eventual FTAAP, building on CPTPP and RCEP, and building out concrete outcomes in the short term that support equity, sustainability and expand economic opportunities for communities around the Asia-Pacific.

Under the theme of Equity. Sustainability. Opportunity. ABAC’s agenda includes a focus on ensuring that micro, small, and medium-sized enterprises (MSMEs) can expand their engagement in the global economy. ABAC is developing a supply chain resilience toolkit, a self-assessment tool for MSMEs seeking to enhance their ability to withstand dramatic economic shifts. ABAC is also calling for a mechanism to support MSMEs as they adapt to the environment, social and governance (EGS) investing.

ABAC is advancing a work plan on digitalization that seeks to embed trust in the heart of the digital economy, address cybersecurity challenges, promote digital upskilling of the region’s workforce, strengthen digital health, and facilitate interoperability for digital trade across borders.

ABAC is also tackling issues at the intersection of trade and sustainability, including launching a study to better understand the impact of carbon border adjustment mechanisms (CBAMs) on the region and how to leverage trade policy to enhance access to goods and services that can contribute to solving environmental challenges. CBAMs, alongside various large scale subsidy programs of environmental goods, have the potential to impact on regional trade and the attainment of an equitable transition.

The ABAC II meeting began with the half day Brunei Business Conference that brought representatives from ABAC and the ASEAN Business Advisory Council (ASEAN-BAC) together with business and government representatives from Brunei. In his opening remarks for the Conference, H.E. Dato Seri Setia Dr Awang Haji Mohd Amin Liew Abdullah, Minister at The Prime Minister’s Office and Minister of Finance and Economy II, noted that collaboration is key to navigating the multiple crises facing the world today. In view of this, Yang Berhormat Dato emphasized the importance of APEC economies remaining optimistic and persistent in their work towards promoting integration and in advocating for sustainable, resilient and inclusive growth.

Pak Arsjad Rasjid, ASEAN-BAC Chairman, also addressed the meeting where he briefed ABAC of his Council’s current work agenda and outlined potential areas of synergy between the two organizations in addressing their shared goals of achieving sustainability, inclusion and digital transformation. As this was the first time that ABAC and ASEAN-BAC have met formally, ABAC Members expressed their desire for further interaction moving forward.

ABAC members also had the chance to visit businesses and organizations that are driving economic growth and innovation Brunei, including CAE Brunei Multi-Purpose Training Centre, Brunei Innovation Lab and Royal Brunei Culinary.

Vietnam to require social media users to verify identity

Vietnam is preparing to make it mandatory for social media users of both local and foreign platforms to verify their identity in a bid to rein in online scams, state media reported. The measure, part of the Telecommunications Law Amendment to be issued by the end of this year, will enable law enforcement agencies to […]

Vietnam to require social media users to verify identity

Vietnam is preparing to make it mandatory for social media users of both local and foreign platforms to verify their identity in a bid to rein in online scams, state media reported.

Vietnam is preparing to make it mandatory for social media users of both local and foreign platforms to verify their identity in a bid to rein in online scams, state media reported.

The measure, part of the Telecommunications Law Amendment to be issued by the end of this year, will enable law enforcement agencies to track down offenders using social media to break the law, state-run Voice of Vietnam (VOV) newspaper reported.

“There are times the authorities can identify social media account holders that violate the laws but cannot track them down because those criminals use cross-border applications,” VOV cited information deputy minister Nguyen Thanh Lam as saying.

“Unverified accounts, no matter on local or foreign platforms such as Facebook, TikTok, YouTube, will be dealt with.”

According to the report, both individual and organisational users would be subject to the measure. However not all providers currently offer identity verification in Vietnam.

The regulation will need the approval of the country’s lawmakers. Details have not been revealed yet.

Vietnam in recent years has issued several regulations together with a cybersecurity law that target foreign social media platforms in a bid to battle disinformation in news and force foreign tech firms to establish representative offices in Vietnam and store data in the country.

Reuters

President lauds VCCI for contributions to national development

President Vo Van Thuong commended the continued, meaningful contributions of the Vietnam Chamber of Commerce and Industry (VCCI) to national construction and development while addressing a ceremony in Hanoi on April 26 marking its 60th anniversary. The Chamber has worked hard to support Vietnamese businesses and offered consultations to the Party and the State on […]

President lauds VCCI for contributions to national development

President Vo Van Thuong commended the continued, meaningful contributions of the Vietnam Chamber of Commerce and Industry (VCCI) to national construction and development while addressing a ceremony in Hanoi on April 26 marking its 60th anniversary.

President Vo Van Thuong commended the continued, meaningful contributions of the Vietnam Chamber of Commerce and Industry (VCCI) to national construction and development while addressing a ceremony in Hanoi on April 26 marking its 60th anniversary.

The Chamber has worked hard to support Vietnamese businesses and offered consultations to the Party and the State on policy making and international integration, the President said.

He asked the Chamber to raise its capacity and overcome limitations and shortcomings to better perform its role and tasks, thus contributing more to national economic development.

The VCCI and the business circle should make greater efforts to promote the Vietnamese brand in the international market, and expand cooperation with international partners for mutual successes, Thuong suggested.

Each businessperson should be well aware of their role in the great national unity bloc, and strengthen solidarity and collaboration with workers, farmers, and intellectuals, he said, noting that the present difficulties should be opportunities for enterprises and businesspeople to grow stronger.

VCCI President Pham Tan Cong recalled the formation and development of the Chamber whose network now covers more than 200,000 enterprises and over 200 associations nationwide.

The VCCI will continue with policy activities and play a more active role in perfecting the institutional environment to nurture and develop Vietnamese businesspeople and enterprises, he said.

It will further support businesspeople and enterprises, and build a code of ethics for them and business culture, helping them position themselves in the international business community, Cong said.

On this occasion, the VCCI made public a council of Vietnam’s leading businesses with 21 members, which will work to boost the development of big Vietnamese firms, expand cooperation, both domestically and internationally, and uphold the role of leading enterprises in the development of sectors and agencies, and in guiding small-and medium-sized enterprises.

VNA

The sources of East Asia’s industrial prowess

As the United States works to limit China’s access to advanced technologies like semiconductors, it cannot ignore its own dependence on small Asian economies like South Korea and Taiwan for many of those same technologies. The question the U.S. and its allies must ask, then, is how reliable these economies are as producers. Examining […]

The sources of East Asia’s industrial prowess

The Samsung Electronics Co. smartphone manufacturing factory stands in this aerial photograph taken above Gumi, South Korea, on Sunday, April 5, 2020. Samsung unveils preliminary earnings Tuesday, becoming one of the first major technology corporations to paint a picture of how the pandemic impacted the global tech industry in 2020s first three months. Photographer: SeongJoon Cho/Bloomberg

As the United States works to limit China’s access to advanced technologies like semiconductors, it cannot ignore its own dependence on small Asian economies like South Korea and Taiwan for many of those same technologies. The question the U.S. and its allies must ask, then, is how reliable these economies are as producers.

Examining South Korea’s industrial successes can go a long way toward providing an answer. It is by now old news that the Korean giant Samsung Electronics has surpassed Japan’s Toshiba and America’s Intel to become the world’s top chip producer (by revenue). But South Korean industry’s prowess extends well beyond semiconductors.

For example, Hyundai Motors recently became the world’s third-largest carmaker, after Toyota and Volkswagen — with quality to match. Hyundai and its sister company Kia took the top spots in this year’s J.D. Power Vehicle Dependability Study, beating Toyota and General Motors. And in both 2022 and 2023, the World Car Awards named Hyundai’s electric vehicle (EV), the Ioniq, “world car of the year.”

South Korea’s arms industry also is growing fast. Taking advantage of the opportunity created by the Ukraine war, firms have increased arms exports to the West — for example, selling K9 self-propelled howitzers and infantry fighting vehicles to Poland. Moreover, in February, Korea Aerospace Industries confirmed a deal to sell 18 fighter jets to Malaysia’s government. Hanwha Group, which has grown rapidly since acquiring Samsung’s chemicals business in 2014, is now expected to acquire Daewoo Shipbuilding & Marine Engineering — one of the country’s top ship makers, which also produces military vessels and submarines.

South Korean firms are even making headway in biotechnology. The barriers to entry for such long-cycle sectors are high and some South Korean firms tried and failed in the 1990s to break in. But the COVID-19 pandemic created a window of opportunity and South Korean firms did not miss it. Since 2020, three biotech companies — Samsung Biologics, Celltrion and LG Chemical — have been among the top 10 companies trading on Seoul’s stock market.

It is worth noting that this list also includes NAVER, a South Korean counterpart to Google, and Kakao, Korea’s Facebook. This makes South Korea one of just a few countries — such as China — where homegrown digital platforms outperform those of America’s tech giants.

South Korean firms have thrived by seizing external opportunities as they have arisen. Their agility — and their success more broadly — is rooted partly in their structure: the economy is dominated by diversified family-owned conglomerates known as chaebols.

The chaebols’ track record is hardly spotless. They were widely criticized for helping to fuel the Asian Financial Crisis of the 1990s by investing excessively with borrowed money. But while roughly one-third of the top 30 chaebols went bankrupt during the crisis, the rest were reborn as profitable global players.

Family ownership enables quicker decision-making and longer strategic time horizons than are typical of Western-style hired management, which might be less willing to pursue innovation that could disrupt existing business for the sake of a firm’s long-term success. Stable ownership supports long time horizons for risk-taking.

LG’s rise as a leading electric-battery producer would never have happened were it not for the vision of its founder’s grandson and chairman, Koo Bon-moo. Even as losses piled up, Koo remained committed to developing world-leading battery technology over the course of nearly 20 years. Thanks to his tenacity, LG Energy Solution is now the top battery-maker in the global market, excluding China.

To be sure, family ownership is also prone to opaque corporate governance and entrenched management. But increased public scrutiny in recent years has led to important progress on these fronts. Many chaebols now employ a two-pronged leadership structure, with the family owners leading alongside hired professional CEOs with strong incentive packages.

This has proved to be a winning combination. It was Samsung founder Lee Byung-chul who, over the objections of his management team, decided that the company would begin producing semiconductors. And it was two CEOs, Yun Jong-yong and Kwon Oh-hyun, who, after seven years of losses, made the chip business profitable. Yun and Kwon were both given substantial autonomy and financial incentives, while the Lee family and its staff provided constant monitoring and updates on the business.

Chaebols have often succeeded by leapfrogging over incumbents. As the digital revolution took hold, for example, South Korean firms were able to pioneer cutting-edge products, while the Japanese incumbents were weighed down by analogue technologies. When Samsung and LG launched the world’s first digital television in the American and European markets in the 2000s — the result of a decade-long joint public-private research-and-development effort — Japanese firms were still attempting to market high-definition analogue TVs. Sony had long been the leading TV maker, but it could not compete in global markets that had already turned to digital.

In a sense, Hyundai, under the leadership of its founding family’s third generation, has replicated this dynamic in its EV business. Toyota was a first-mover in the hybrid-vehicle market. Rather than playing catch-up, Hyundai focused on developing purely electric passenger vehicles, as well as hydrogen-powered trucks and buses. As soon as consumer demand for EVs was sufficiently well-established, Hyundai ramped up its EV production.

A corporate structure that plays to the strengths of both family ownership and professional management, together with the vision to seize opportunities as they arise, has enabled firms from a small East Asian country to become major global players. Their agility and capacity for innovation, together with their reliability, is good news for the West.

Project Syndicate

Successful Trade Finance Training held in Hanoi and HCMC