Indonesia and Russia to build $22b refinery in East Java among other projects

Indonesia and Russia are set to work together on several projects, even as the West is isolating Russia in response to its invasion of Ukraine. Indonesian state-owned oil company Pertamina and Russia’s Rosneft Oil Company are going ahead with their project to build a refinery in the Indonesian province of East Java to produce fuel […]

Indonesia and Russia to build $22b refinery in East Java among other projects

Indonesia and Russia are set to work together on several projects, even as the West is isolating Russia in response to its invasion of Ukraine.

Indonesian state-owned oil company Pertamina and Russia’s Rosneft Oil Company are going ahead with their project to build a refinery in the Indonesian province of East Java to produce fuel and raw materials for the petrochemical industry, a senior Indonesian government official told The Straits Times on July 1.

“The Russian party has been negotiating to get tax holidays. The project is still on track,” said the official, who supervises the project and spoke on condition of anonymity.

The two state-owned companies earlier formed a Jakarta-based joint venture, PT Pertamina Rosneft Pengolahan dan Petrokimia, which will manage the East Java’s New Grass Refinery Root (NGRR) in Tuban and have an output of 229,000 barrel per day of gasoline, diesel and jet fuel.

A pre-project planning phase has been completed for the US$16 billion (S$22 billion), which will be 45 per cent owned by Rosneft and 55 per cent by Pertamina.

Pertamina chief executive Nicke Widyawati did not respond to The Straits Times’ request for a comment.

When completed, the project will greatly help Indonesia reduce its reliance on imported fuel, which has been rising in price.

To make fuel prices affordable, the administration has increased energy subsidies this year to a staggering 502.4 trillion rupiah (S$46.8 billion), from the originally budgeted 152.2 trillion rupiah.

The Russian embassy in Jakarta also said President Vladimir Putin offered to have Russian Railways invest in Indonesia’s new capital in Kalimantan. The new capital, named Nusantara, will see construction start in August after delays due to the pandemic.

The government has earlier invited investors including Abu Dhabi and Taiwan’s Foxconn Technology Group to help build the renewable energy-powered new capital city.

Russian energy companies are also keen to come and invest in Indonesia, especially in developing nuclear power to provide electricity, Mr. Putin said during Mr. Widodo’s visit to Moscow, according to the Russian embassy statement. Indonesia has a power shortage, especially in regions in Kalimantan and Sulawesi.

How Persistent Inflation Is Causing Procurement to Adapt

It has been almost two years since the first signs of inflation, ignited by the COVID-19 pandemic, began appearing across the global industrial landscape. From the summer of 2020 through late 2021, prices rose steadily across the board — on everything from raw materials to labor. Since then, conditions have begun to moderate. Most nations […]

How Persistent Inflation Is Causing Procurement to Adapt

It has been almost two years since the first signs of inflation, ignited by the COVID-19 pandemic, began appearing across the global industrial landscape. From the summer of 2020 through late 2021, prices rose steadily across the board — on everything from raw materials to labor.

It has been almost two years since the first signs of inflation, ignited by the COVID-19 pandemic, began appearing across the global industrial landscape. From the summer of 2020 through late 2021, prices rose steadily across the board — on everything from raw materials to labor.

Since then, conditions have begun to moderate. Most nations are lifting pandemic-related mandates, and the massive labor shortages that plagued companies in 2020 and 2021 are starting to subside. The one major exception, of course, is China where full-lockdown conditions akin to 2020 have returned, following recent COVID variant outbreaks.

In the United States, for example, rising wages and the phaseouts of foreclosure moratoria and extended unemployment insurance have coaxed more people back to work. Unemployment in March was just a tenth of a percentage point above its level in February 2020. The labor force participation rate, which measures the percentage of the population either working or actively looking for work, was 62.4% in March, up from a multidecade low of 60.2% in April 2020. While that isn’t quite back to the pre-pandemic level of 63.4% recorded in February 2020, the trend is clear.

Photo: Unsplash

Aggravated by Geopolitical Conflict

What hasn’t reversed is inflation, particularly in raw materials prices. For many commodities, the world is dealing with successive and excessive increases that have, in some cases, doubled or even tripled the prices. While the increases were initially fueled by COVID-related supply chain disruptions and the rapid rebound in economic activity in 2021, they were driven even higher by the Russian invasion of Ukraine on February 24. For example, as Russian tanks rumbled across the border, the cost of plastic spiked — 71% above its pre-pandemic level in the United States and 112% higher in Europe. Today, U.S. steel prices are 76% higher than in March 2020 and 184% higher in Europe. On the London Metal Exchange, spot prices for aluminum were 98% above March 2020 levels.

Although the global economy remains very much in flux, companies with unwavering focus can identify and capture the opportunities bred by the current supply chain scramble.

Perhaps no single commodity tells the global economy’s inflationary tale of woe more than overseas shipping container rates. As measured by the Freightos Baltic Index of China/East Asia to Northern Europe, these rates jumped an astounding 822% higher than they were on the eve of the pandemic. Simply put, while labor shortages are showing signs of easing in some sectors, raw materials prices aren’t anywhere close to normalizing. Obviously, the implications of such unrelenting inflation are enormous for businesses trying to get on an even keel.

Yet, uncertainty breeds opportunity, and today’s mixed-bag economy is opening opportunities that companies should be more willing to exploit rather than take a wait-and-watch approach. Some of the biggest openings for an innovative business approach will come on the value-add side of manufacturing, where companies can tap their growing workforces to optimize cost structures.

Exploiting the Value-Add

In today’s seemingly chaotic but value-rich sourcing environment, the biggest key to success will be in drawing the distinction between purchased items with meaningful value-add steps and components that are 80% or more raw material-dependent. Examples of components with meaningful value-add steps include plastic and aluminum extrusions, stamped or machined metal parts, molded plastic products, motors, fans, and other semi-finished goods. Raw material-dependent components include steel wire rod, plastic resin, metal ingots, and other items.

In the current environment, cost structures of components with higher value-add steps have been somewhat insulated from wild raw material price fluctuations, given that raw materials generally comprise no more than 15% of the total cost of the component. In contrast, heavy raw material-dependent components have been susceptible not only to continued rising prices but also to extreme swings, which have made planning difficult.

In addition, many previously “underrepresented” markets have gained meaningful share from the more established raw material markets. For example, several types of lumber and wood products like furniture, previously thought of as a stronghold for Chinese and East Asian products, are now being sourced from Eastern Europe at a growing rate. The massive hike in ocean shipping rates from Asia has made European and U.S. suppliers significantly more cost competitive. Of course, the conflict in Ukraine might change the dynamics when it comes to Europe.

Capitalizing on Variables

The COVID-19 outlook in China remains the biggest variable on the supply chain front, while the conflict in Ukraine holds the potential to cause continued price increases of many raw materials and energy, particularly in Europe.

Private capital investors and operators need to act now to seize value-creation opportunities centered on optimizing the costs of procured materials while simultaneously identifying potential acquisition targets with true latent value.

Although the global economy remains very much in flux, companies with unwavering focus can identify and capture the opportunities bred by the current supply chain scramble.

This article was made possible with the support and insights from Tushar Narsana and Karina Swette.

Apurva Nair

Apurva Nair

Partner at Oliver Wyman

Apurva Nair is a partner with the Private Equity practice and a leader in the post-deal value-creation team. He drives enterprise value by delivering tangible financial benefit to clients in accelerated time frames. He has a dual focus on driving the bottom line via strategic sourcing and transactional pricing, and organic top-line revenue growth via sales analytics.

The original report can be read at the Brink’s website HERE.

ACCI welcomes closer economic ties with India

The Australian Chamber of Commerce and Industry (ACCI) welcomes the Morrison Government’s continuing focus on strengthening economic ties with India, the world’s largest democracy. As a member of the International Chamber of Commerce (ICC) and Business at the OECD, ACCI plays an active role in advocating on behalf of Australian business for open markets and […]

ACCI welcomes closer economic ties with India

The Australian Chamber of Commerce and Industry (ACCI) welcomes the Morrison Government’s continuing focus on strengthening economic ties with India, the world’s largest democracy.

As a member of the International Chamber of Commerce (ICC) and Business at the OECD, ACCI plays an active role in advocating on behalf of Australian business for open markets and private sector-led growth.

“Given local businesses have been hard hit by COVID, now is the perfect time to continue to bolster economic relations with India and work towards finalising a comprehensive Free Trade Agreement (FTA) as soon as possible” ACCI CEO Andrew McKellar said.

“What we know is that our high-quality Australian made products are in demand overseas and a free trade agreement with India would make it easier and more accessible for local enterprises to sell their products to one of the world’s largest and fastest growing economies.”

“We welcome the Government’s efforts in launching the three Maitri initiatives allowing high achieving Indian talent to study in Australia, supporting professionals to collaborate on research and boosting the role of creative industries. These initiatives continue to build the groundwork for an FTA.”

“The renewal of the Australia-India Memorandum of Understanding on Tourism Cooperation is also a step in the right direction.”

“Even though our international border is opening on 21 February, what was previously our biggest source of tourists, China, remains largely closed due to outbound travel restrictions so it is important that we look to diversity our tourism sector so that it can open and continue to operate.”

“Over 300,000 Australian tourism businesses and their 700,000-strong workforce are set to benefit in growing our tourism relationship with India.”

“The immediate removal of the import tariff on Australian lentils is also a welcome and important move. Many farmers will reap significant benefits from this new trade condition given they saw a record grain harvest this year.”

“Two-way trade with India was worth over $24 billion in 2020 and in the five years before the pandemic this two-way trade and investment doubled. A free trade partnership between our two countries would work to further cement our strong and growing trade relationship.”

“As we have seen with other free trade deals, this would not only benefit Australian businesses but individuals as well through increased job opportunities.”

ACCI Newsroom

Cyber Disaster Risks Are Mounting

As the U.S. kicks off the 2022 hurricane season, another potential disaster looms large. With the Russian invasion of Ukraine and other ever-present the criminal and terrorist threat actors, the risk of a cyber disaster is mounting. Meanwhile, those responsible for responding to such a disaster remain largely focused on “traditional” disasters. As the head […]

Cyber Disaster Risks Are Mounting

As the U.S. kicks off the 2022 hurricane season, another potential disaster looms large. With the Russian invasion of Ukraine and other ever-present the criminal and terrorist threat actors, the risk of a cyber disaster is mounting. Meanwhile, those responsible for responding to such a disaster remain largely focused on “traditional” disasters.

As the U.S. kicks off the 2022 hurricane season, another potential disaster looms large. With the Russian invasion of Ukraine and other ever-present the criminal and terrorist threat actors, the risk of a cyber disaster is mounting. Meanwhile, those responsible for responding to such a disaster remain largely focused on “traditional” disasters.

As the head of the U.S. Department of Homeland Security agency responsible for managing these risks, Cybersecurity & Infrastructure Security Agency (CISA) Director Jen Easterly described the threat landscape and identified potential targets in a recent 60 Minutes interview. “We are seeing evolving intelligence about Russian planning for potential attacks. And we have to assume that there’s going to be a breach. There’s going to be an incident. There’s going to be an attack.” Director Easterly identified the energy and finance sectors as particularly likely targets.

Most assume cybersecurity to be the domain of technology professionals. As Carolyn Harshman, president of the International Association of Emergency Managers told me: “Too often, cybersecurity is thought of as a business continuity or IT issue.” The reality is that those on the front lines of managing the physical consequences of a cyber disaster would be the same who respond to hurricanes, tornadoes and floods. “These are the emergency managers at all levels of government and the first responders in each of our communities,” said Harshman.

Recall the ice storm that crippled the electric grid in Texas last year. The cold weather exacerbated the power loss, as those impacted struggled to stay warm and care for themselves and their families. Imagine instead it was a cyberattack that caused the disruption. The consequences would be the same, or worse. Such an attack could be timed to coincide with high energy demand, such as the summer months when health risk from heat is highest. Thousands could die if timed for greatest impact.

Just as emergency managers and first responders prepare for “traditional” disasters, so too must they prepare for cyber disasters.

Photo: Getty Images

Pandemic Lessons

Not only is the cyber threat real, but a seemingly unrelated disaster demonstrates why preparing for a cyber disaster should be a priority. The pandemic has yielded lessons that a cyber preparedness plan should include.

First, the pandemic exposed vulnerabilities in many sectors. From inadequate security safeguards for largely remote workforces to supply chain shortages of critical technologies, COVID demonstrated the potential shortfalls in the nation’s ability to protect itself from future cyberattacks. These vulnerabilities could amplify any impacts from an attack, thereby complicating a response to the physical consequences of a cyber disaster.

Second, the pandemic forced the cancellation of a major cyber exercise that we had spent years planning at the Federal Emergency Management Agency (FEMA). National Level Exercise 2020 (NLE 2020) would have been the nation’s largest cyber exercise. Without it, the realistic scenario it envisioned was not tested, and the gaps it would have likely exposed have not been closed.

Americans are ill equipped to defend against the increasing sophistication and volume of cyberattacks.

Third, the pandemic also laid bare the challenges facing emergency managers as “all hazards” practitioners. Just as many mistakenly believed early in the pandemic that COVID was a health emergency and only belatedly realized the role of emergency managers, so too are catastrophic cyber incidents also almost certain to fall to emergency managers.

What Can Be Done?

What can be done to prepare those charged with protecting us from the consequences of cyber disasters? Much like a “traditional” disaster, preparing for future contingencies is critical. This should include core elements of preparedness such as planning, training, equipment and exercises.

Having overseen FEMA preparedness programs from 2017-2020, I directed an internal review of agency cyber preparedness program. In 2019, I publicly released our findings: “We offer over 20 online and in-person courses, focused on everything from network assurance and digital forensics, to information security and cyber incident response. Since 2004, FEMA has trained more than 87,000 federal, state, local, tribal and territorial officials on cybersecurity.”

Today, FEMA offers over 40 such courses. The challenge, says IAEM President Harshman, “is to ensure that emergency managers are aware of and have access to these courses.” Further, “Cybersecurity must be integrated into existing ‘traditional’ emergency management courses to ensure cyber response becomes a core competency of our profession.”

I also found during our earlier FEMA review that the agency had provided $165 million over 10 years to strengthen state and local government cyber preparedness. While it seemed substantial at the time, it pales in comparison to the overall need. Thus the $1 billion cyber grant program included in the recently enacted infrastructure law represents an unprecedented opportunity to bolster state and local preparedness for cyber disasters. FEMA and CISA are currently finalizing the grant guidance for the new program, which is anticipated to be released this summer.

To ensure a robust response should a catastrophic cyber disaster occur, a strong working relationship between the government agencies responsible for cybersecurity and disaster preparedness is necessary. At the federal level in the U.S., this is principally FEMA and CISA. When I was at FEMA, we made it a priority to collaborate with CISA. Whether it was grant guidance, exercises such as NLE 2020, or response planning, we worked with our sister DHS agency as partners. Going forward, such a partnership will be critical.

In a January 2022 position paper, the National Emergency Management Association (NEMA) stated that “questions abound relating to the federal government’s processes for responding to major cybersecurity attacks.” To address these concerns, the association representing state emergency management directors proposed an Integrated Program Office between FEMA and CISA to “coordinate all policy and response doctrine as it would apply to cybersecurity, critical infrastructure protection, and any other subject of shared interest.”

The same collaboration should be a priority at the state and local levels and with the private sector. State and local governments should pair their technical experts (Chief Information Security Officers), with their operational responders (emergency managers). And given that the vast majority of the nation’s critical infrastructure is owned by the private sector, this is not a challenge the government alone can solve. Strong partnerships between industry and all levels of government will be necessary to confront this threat.

Finally, at the individual level, we must all take our cyber responsibilities seriously. Brian Hastings, director of the Alabama Emergency Management Agency, told me “Americans are ill equipped to defend against the increasing sophistication and volume of cyberattacks.” Hastings, who also chairs the NEMA Homeland Security Committee added: “Humans are simultaneously the vulnerability, the target, the enemy, and the solution on the front lines making cybersecurity awareness, training, and education a shared responsibility and crucial to reducing our collective risk to attacks.”

Cyber Preparedness Must Be a Priority

A new RAND study finds that responding to a cyber disaster will likely be far more challenging than responding to a traditional disaster. Largely this is because of the nation’s inexperience with responding to catastrophic cyber incidents and thus officials must develop plans and test these capabilities before an incident occurs. The study provides yet more evidence that bolstering the nation’s cyber preparedness now should be a national priority.

Just as emergency managers and first responders prepare for “traditional” disasters, so too must they prepare for cyber disasters. Just because there isn’t a cyber disaster season, doesn’t mean it isn’t time to prepare now.

Related themes: CYBERSECURITY

Daniel Kaniewski

Managing Director, Public Sector at Marsh McLennan Advantage@dankandc

Daniel Kaniewski is the managing director of Public Sector at Marsh McLennan Advantage. Prior to joining the firm in February 2020, Dr. Kaniewski was the deputy administrator for resilience at the Federal Emergency Management Agency (FEMA). In this role he was FEMA’s second-ranking official and led the agency’s pre-disaster programs. He was unanimously confirmed by the U.S. Senate on September 14, 2017.

FEMA Could Be America’s Climate Adaptation Agency — What Is the Biden Administration Waiting For?

When a 100-Year Disaster Strikes

The Value of Disaster Planning Outweighs Its Cost — Sixfold

The original report can be read at the Brink’s website HERE.

9 Takeaways From Davos

The annual World Economic Forum took place in Davos last week for the first time in three years. The high-profile gathering of corporate executives and politicians was smaller than usual and was held in May instead of January. Here are some of the highlights. The managing director of the International Monetary Fund sought to dispel […]

9 Takeaways From Davos

The annual World Economic Forum took place in Davos last week for the first time in three years. The high-profile gathering of corporate executives and politicians was smaller than usual and was held in May instead of January. Here are some of the highlights.

The annual World Economic Forum took place in Davos last week for the first time in three years. The high-profile gathering of corporate executives and politicians was smaller than usual and was held in May instead of January. Here are some of the highlights.

The managing director of the International Monetary Fund sought to dispel the gloom at the World Economic Forum, saying a global recession isn’t in the cards, but “it doesn’t mean it’s out of the question.” Kristalina Georgieva noted that the IMF expects economic growth of 3.6% for 2022, but acknowledged that it’s going to be a “tough year.”

A global buyers’ club of more than 50 companies, including Microsoft and Ford Motor, say they will buy “green” steel, aluminum and other commodities by 2030. The idea behind the buyers’ club, known as the First Movers Coalition, is to stoke demand for green versions of materials that have proved difficult to manufacture without significant carbon dioxide emissions.

The aviation industry, decimated during the pandemic, is rebounding strongly, said Hassan El Houry, CEO of National Aviation Services. He predicted the airline industry would return to pre-pandemic levels at the end of this year or the middle of next, earlier than airline industry group IATA’s forecast of 2025. “Almost every airline I speak with is reporting a huge rebound, especially for this summer and particularly in leisure travel.”

Klaus Schwab, founder of the World Economic Forum, introduces Ukrainian President Volodymyr Zelenskyy during the 2022 World Economic Forum Annual Meeting.

Photo: World Economic Forum/Sikarin Fon Thanachaiary via CC

Ukrainian President Volodymyr Zelenskyy says that his country will not give up land to end Russia’s war. Speaking by video link Wednesday, Zelenskyy said through a translator that “Ukraine is not going to concede our territory. We are fighting in our country, on our land.” Meanwhile, Henry Kissinger, the 98-year-old former secretary of state urged Ukraine to cede territory to make peace with Russia.

Cryptocurrencies … ‘are not currencies at all …they are speculative assets, the value of which changes enormously over the course of time … coin issuers should have to back up their coins with as many dollars as they have coins.’

The Chairman of Volkswagen, Herbert Diess, says Volkswagen is seeing a “clear improvement through summer” on the supply of microchips it needs for its vehicles. Audi board member Hildegard Wortmann said the VW-owned brand has its “highest level of orders at the moment,” but customers are facing wait times of about a year or more.

An international deal to force the world’s biggest multinational companies to pay a fair share of tax has been delayed until 2024, amid fresh wrangling over the painstakingly negotiated agreement. Mathias Cormann, the secretary-general of the Organisation for Economic Co-operation and Development (OECD) said he remained confident an agreement would eventually be implemented to let countries levy more tax on the world’s largest firms based on the sales generated within their borders.

Israeli President Isaac Herzog called on other nations to consider a “renewable Middle East” as a resource for sustainable food, water and energy solutions. He appealed for a new partnership with nations in Europe, Asia and Africa modeled in part on the economic agreements Israel has struck with four Arab nations. He said such new links would expand a “zone of understanding, despite wide gaps and conflicting narratives” about a surge in violence between Israel and the Palestinians.

The World Economic Forum has unveiled an initiative to develop the metaverse. The forum said that it will work with businesses, regulators, civil society and academic experts to help define and build the metaverse. The focus will be on governing the metaverse as well as how to create economic and societal value.

European Central Bank President Christine Lagarde criticized cryptocurrencies, saying that they “are not currencies at all …they are speculative assets, the value of which changes enormously over the course of time … coin issuers should have to back up their coins with as many dollars as they have coins. That needs to be checked, supervised, and regulated.” Lagarde’s latest comments come after she told a Dutch talk show: “My very humble assessment is that [crypto] is worth nothing, it is based on nothing — there is no underlying asset to act as an anchor of safety.”

Related themes: CLIMATE ADAPTATION INFLATION METAVERSE UKRAINE

Editorial Staff BRINK

Despite Progress, Food Insecurity Remains Key Global Challenge

U.S. Within 15 Years of Energy Independence

The original report can be read at the Brink’s website HERE

Global Insurance Pricing Increases in First Quarter 2022

Global commercial insurance prices rose 11% in the first quarter of 2022, marking the fifth consecutive reduction in rate increase since global pricing increases peaked at 22% in the fourth quarter of 2020. It was, however, the eighteenth consecutive quarter that composite prices rose, continuing the longest run of increases since the inception of the Marsh […]

Global Insurance Pricing Increases in First Quarter 2022

Global commercial insurance prices rose 11% in the first quarter of 2022, marking the fifth consecutive reduction in rate increase since global pricing increases peaked at 22% in the fourth quarter of 2020.

It was, however, the eighteenth consecutive quarter that composite prices rose, continuing the longest run of increases since the inception of the Marsh Global Insurance Market Index in 2012.

Cyber insurance pricing continues to show significant rate increases — 110% in the U.S. and 102% in the U.K. for the quarter — and has driven up average pricing in financial and professional lines, globally.

Q1 2022 marks the fifth consecutive reduction in insurance rate increases since global pricing increases peaked at 22% in the fourth quarter of 2020. from their high in 2020.

Photo: Unsplash

The U.K. had the highest average increase, with composite pricing increases at 20%, down from 22% in the fourth quarter of 2021. Both the U.S. and Pacific also saw composite pricing increases in the double digits — 12% and 10%, respectively.

Latin America and the Caribbean was the only region to see its composite pricing increases rise, from 4% in the fourth quarter of 2021 to 6% in the first quarter of 2022.

All three major product lines showed increases in average pricing globally, though less than the prior quarter: financial and professional lines (26%), property (7%), and casualty (4%).

Cyber Claims and Systemic Exposure Concerns Escalate Financial and Professional Lines in US

The average rate of composite price increase in the first quarter of 2022 in the U.S. was 12% — a slight reduction on the prior quarter (13%). This again was driven by cyber insurance pricing.

Average property insurance pricing for the quarter increased 7%, as it did in the fourth quarter of 2021. Clients with significant losses, poor risk quality, or significant exposure to secondary catastrophe (CAT) perils — including wildfire, convective storm, and pluvial flood — continued to experience above average rate increases.

Casualty insurance pricing increased 4% on average in the first quarter of 2022, which was the same increase as the prior quarter.

Financial and professional lines pricing increased 28% on average this quarter. Though increases are still being driven significantly by cyber insurance price increases, this quarter’s average increase was lower than that of the fourth quarter of 2021 (34%).

Directors and officers (D&O) liability insurance pricing for publicly traded companies increased 3% on average — this was lower than the 6% increase of the prior quarter.

Pricing for cyber insurance increased 110% on average, in large part due to the re-pricing and re-underwriting of cyber risks. Prolific claims activity contributed significantly to pricing increases. The conflict in Ukraine also exacerbated concerns relating to systemic exposures and accumulation risk.

UK Pricing Moderates Despite Rising Cyber Pricing Increases

Composite insurance pricing in the first quarter of 2022 in the U.K. increased 20%, compared to 22% in the fourth quarter of 2021.

Cyber insurance pricing increased by 102% on average, again driven by ransomware claims.

Financial and professional lines pricing increased 39%, on average, down from 43% in the prior quarter. D&O pricing increases demonstrated a degree of moderation, with average pricing increases of 16% in the first quarter of 2022, compared to 24% in the fourth quarter of 2021.

Cyber insurance pricing increased by 102% on average, again driven by ransomware claims; this was up on the prior quarter, which had an average increase of 92%.

Property insurance pricing increased by 9%, compared to 10% in the prior quarter; and casualty insurance pricing increased 3% on average, down from a 4% increase in the prior quarter.

Pace of Pricing Increase in Asia Continues Decline

Composite insurance pricing in the first quarter of 2022 in Asia increased 3%, down from 4% in the prior quarter, as price increases continue to moderate.

Both property insurance and casualty insurance saw average pricing increases of 2% in the quarter; while property insurance was down on the prior quarter’s pricing increases of 3%, casualty insurance increases were 2% for both quarters.

Financial and professional lines pricing increased 13% on average, down from 17% in the prior quarter. The cyber market remained challenging, with ransomware placing considerable pressure on premiums.

Insurance Pricing by Region

Other regional highlights in the first quarter included the following:

In the Pacific, composite insurance pricing increased 10%, on average, down from 13% in the prior quarter. Property insurance pricing increased 8%, on average, mirroring the increases seen in the prior quarter. Losses from the New South Wales and Queensland floods reduced any potential pricing relief. Casualty insurance pricing rose 15%, while financial and professional lines pricing rose 10% — a decrease from 18% in the prior quarter.

Composite insurance pricing in the first quarter of 2022 in Continental Europe increased 6%, compared to 9% in the prior quarter. Property insurance pricing rose 6%, a decrease from 10% in the prior quarter, with CAT-exposed risks experiencing the largest increases. Financial and professional lines pricing increased 9% on average, down from 13% in the prior quarter. The D&O market had an influx of new capacity, which led to rate reductions on select programs with adequate pricing. Average casualty insurance pricing rose 6%.

Average composite insurance pricing in the first quarter in the Latin America and Caribbean region increased 6%, up from 4% in the prior quarter. Casualty pricing in the region was flat, marking a potential shift from decreasing rates in the space. Property insurance pricing increased 8%, up from 7% in the previous quarter. Financial and professional lines pricing rose 11%, down slightly from the 12% increase in the prior quarter.

Related theme: INSURANCE

Lucy Clarke

Lucy Clarke

President of Marsh Specialty and Global Placement

Lucy is president of Marsh Specialty, president of Marsh Global Placement, and is a member of the Marsh executive committee. Lucy joined Marsh in April 2019 as part of the acquisition of JLT Group, where she worked for 17 years in key leadership roles, including CEO of JLT Specialty, the insurance and risk arm of the JLT Group. Lucy graduated from Vanderbilt University and has worked in London since 1990.

Global Insurance Pricing Increases in Fourth Quarter 2021

Global Insurance Pricing Increases in Third Quarter 2021

Ransomware Attacks Are Becoming More Frequent, Severe and Expensive

The original report can be read at the Brink’s website HERE.

We Need a More Resilient Food System

The World Food Program has warned that 275 million people are facing starvation as a result of global food shortages caused by the Ukraine conflict, bottlenecks in the supply chain, and crop failures in India and China. Sheryl Hendriks, a food security expert at the University of Pretoria in South Africa, says that one of […]

We Need a More Resilient Food System

The World Food Program has warned that 275 million people are facing starvation as a result of global food shortages caused by the Ukraine conflict, bottlenecks in the supply chain, and crop failures in India and China.

The World Food Program has warned that 275 million people are facing starvation as a result of global food shortages caused by the Ukraine conflict, bottlenecks in the supply chain, and crop failures in India and China.

Sheryl Hendriks, a food security expert at the University of Pretoria in South Africa, says that one of the big problems is the lack of private sector involvement in the food sector in many countries.

A man harvests tea on a mechanized tea estate in Kericho, Kenya. To learn from the current global food shortages, countries will need to invest in mechanization and encourage private sector development.

Photo: Patrick Sheperd/CIFOR via CC

HENDRIKS: David Beasley, the head of The World Food Program, says that the situation is already so bad that they are having to choose between the hungry and the starving. What’s unfolding is both a short- and a longer-term crisis. A third of the world’s grain supplies and a large proportion now of oil seeds are tied up in Russia and Ukraine.

There’s food sitting from the previous harvest that can’t be moved out to the places that need the food. Much of the rail infrastructure and some ports in Ukraine have been damaged or destroyed, so while the silos are full, food can’t get out to those who need it. And countries in Africa are particularly reliant on imported grain from those two countries.

Banning Food Exports Is Short Sighted

There’s a secondary aspect to this crisis because Ukraine and Russia also provide significant amounts of fertilizer for agriculture. Higher processing costs and lower availability will be major constraints to future harvests. Fertilizer prices were already going up last year, because fertilizer prices are linked to crude oil prices, so we were seeing farmers in Africa using less fertilizer, and that affects their harvests.

BRINK: Some countries are banning food exports as a way to husband their own resources. Will that make things worse or not?

HENDRIKS: Absolutely. There is some logic to holding back a proportion of food in order to meet your domestic requirements, but for example, Indonesia’s outright ban on the export of palm oil is going to have major repercussions. What happens if they run short of another commodity? Their neighbors are not going to be very friendly about sharing what they have.

So in terms of neighborliness, bans are fairly shortsighted. It also means that countries could lose their market share because somebody else will step into the market and fulfill their requirements. The palm oil restriction is going to affect a huge proportion of processed foods in particular, such as snack foods and many cheaper brands of ready-to-eat foods that are the go-to foods for busy urban communities.

BRINK: Let’s turn to possible solutions. How do you make sure that this crisis isn’t wasted as an opportunity?

HENDRIKS: Good question. We wasted the learning opportunities from the previous two high food price crises in 2007/8 and 2013. Countries should have responded to these crises by looking at their domestic production and seeing how they could diversify to ensure higher domestic supplies.

The response to the 2007/2008 food crisis in many African countries was to provide free or highly subsidized fertilizer and seeds to boost the production of grains. And for example, in West Africa, there was a significant response by farmers. But then the upstream distribution, storage, and transport components were lacking, and so a lot of that excess harvest just rotted the next year. We haven’t really learned much in terms of creating the right balance between import, export, and domestic production.

The Complicated Role of Governments

One of the dynamics in many developing countries is that, unlike in the West, governments have a huge role to play in the food market. Land is typically owned by the government, the seed supply system is either owned or managed by the government, the fertilizer distribution is highly subsidized, and so are the seeds.

In developing countries, the government is very often the price setter, and the government is the major procurer of grain. It’s not an entirely free market economy. There’s huge government control, and governments see themselves as custodians of the food supply, especially for the staple grains. There are big risks in that.

There’s considerable fear and hesitancy around private sector development in developing countries, but it’s really important for us to support private sector development in order to drive innovation, job creation and economic growth.

BRINK: There’s no shortage of scientific research around food systems and reducing starvation. Why hasn’t that translated into a more secure global food system?

HENDRIKS: Because food is an instrument of politics, I guess. Particularly in the developing world, where the government plays such a big hand in food systems, any major shortfall is going to lead to food riots, and policy change in terms of food is viewed as extremely risky by governments.

In my engagement with government officials, particularly across Africa and with the Malabo Montpellier Panel that I work with, the nervousness of government officials to adopt policy change is very tangible. And scientists are not good at engaging with governments to support decision-making.

The Need to Understand Consumers’ Trade-Offs

BRINK: Do you have any concrete recommendations for how there could be some improvement to food systems?

HENDRIKS: The digital domain provides many opportunities. A colleague, Athula Ginige, has developed a digital app to help farmers make their crop choices, so as an individual farmer, you can keep real-time knowledge of who’s planting what. The app then gives an estimation of the predicted price when it comes to harvesting.

But one thing we don’t understand very well are the trade-offs that consumers are making for convenience products, such as bread. Bread is not a staple food in many African countries, but it’s the go-to because if you have nothing else, you can eat just like that. You don’t need power, you don’t need energy to cook it, you don’t need energy to store or warm it, and because it’s so full of preservatives, it lasts a week.

But there’s a trade-off between convenience and the energy required to prepare alternative meals that require cooking. The complexity lies in the connectedness of food and energy prices. If we were able to invest in producing more ready-to-eat, minimally processed natural foods, rather than additive-laden ultra processed foods, we could perhaps sway consumer choices to healthier meals.

Mechanization Is Critical

Countries also need to invest a lot more in mechanization. There’s considerable fear and hesitancy around private sector development in developing countries, but it’s really important for us to support private sector development in order to drive innovation, job creation and economic growth.

There are some shining examples of mechanization success. In Rwanda for example, the government classified the entire country by agro-ecological zones and then identified the best varieties, for example banana, that would grow in each particular agricultural zone. They then re-orientated their entire extension system to deal with the specific diseases and pests per agricultural zone. There are very clever strategies to encourage people to grow what is relevant for their particular agro-ecological conditions.

Rwanda also invented an Uber-inspired tractor service, where, when a farmer needs a tractor service, they can call the Uber service. And there’s an incentive to keep the tractor maintained, have it full of fuel, and have it ready to run at any time. Rwanda has taken a very holistic approach to development with win-wins for the whole economy. We need more such initiatives where government and private entrepreneurs cooperate.

Related Themes: FOOD SECURITY UKRAINE

Sheryl Hendriks

Sheryl Hendriks

Professor at University of Pretoria

Professor Sheryl L. Hendriks is a professor and head of the Department for Agricultural Economics, Extension, and Rural Development in the Faculty of Natural and Agricultural Sciences at the University of Pretoria. She is a member of the Academy of Science of South Africa.

The original report can be read at the Brink’s website HERE.

The Changing of the Guard in South Korea — What Does It Mean for Business?

The new president elected in South Korea. Yoon Suk Yeol is a populist conservative politician, who narrowly beat President Moon Jae-in from the progressive Democratic party. President-elect Yoon is likely to move South Korea to the right and perhaps take a more confrontational approach to the North. Andrew Yeo, the SK-Korea Foundation Chair in Korea […]

The Changing of the Guard in South Korea — What Does It Mean for Business?

The new president elected in South Korea. Yoon Suk Yeol is a populist conservative politician, who narrowly beat President Moon Jae-in from the progressive Democratic party. President-elect Yoon is likely to move South Korea to the right and perhaps take a more confrontational approach to the North.

The new president elected in South Korea. Yoon Suk Yeol is a populist conservative politician, who narrowly beat President Moon Jae-in from the progressive Democratic party. President-elect Yoon is likely to move South Korea to the right and perhaps take a more confrontational approach to the North.

Andrew Yeo, the SK-Korea Foundation Chair in Korea Studies at Brookings Institution, spoke to BRINK about what this means for the region and for business.

YEO: There’s definitely going to be a change in direction in how the country is governed under this new conservative leadership, even if structural constraints prevent leaders from veering too far off course from the current trajectory.

On domestic policy, we will see less government intervention and deregulation of various industries and sectors to promote economic growth. The government will offer more market-oriented solutions to address domestic problems, particularly the shortage in affordable housing.

President Yoon Suk Yeol stands before a microphone on a podium to address an audience.

BRINK: Can you give us a sense of who Yoon Suk Yeol is?

YEO: Yoon Suk Yeol is considered an elite in South Korea, in contrast to the more humble, social activist background of current president Moon Jae-in. He is a lawyer by training and attended Seoul National University. Yoon’s biggest claim to fame is his role as the prosecutor- general under the Moon government, where he played a leading role convicting former conservative president Park Geun-hye on corruption charges.

Yoon seems to demand loyalty from his followers, and thus far, he has surrounded himself with trusted advisers, including many who served under former President Lee Myung-bak in the late 2000s and early 2010s. This is in contrast to former President Moon Jae-in, who sought greater diversity and inclusiveness among his staff.

The clearest shift in South Korean foreign policy will be the new government’s engagement policy toward North Korea. All Korean governments, whether progressive or conservative, want inter-Korea relations to improve. How you get there, however, differs between progressives and conservatives.

Championing Small Business Over Big Conglomerates

BRINK: How would you characterize his relationship with South Korea’s business community?

YEO: Conservative governments in South Korea tend to have a better relationship with big business in part because they’re more keen in promoting market-oriented policies. But in this case, there might also be some tensions, as the president-elect has emphasized promoting small and medium enterprises (SMEs), which may lead to some competition with the big conglomerates. Yoon seems keen in cultivating the digital economy and may promote policies which support innovation among SMEs in the emerging technology space. Overall, the relationship between government and business should be generally positive, however.

The Trade Relationship With China

BRINK: What about the commercial relationship with China — do you see that changing much?

YEO: Given Yoon’s pro-U.S. stance, some might assume that the new government will adopt a more hardline position toward China.

President-elect Yoon has indicated more willingness to speak out against China on issues such as human rights and freedom of expression. The new government will be less tepid in how it engages China and more willing to assert its own geopolitical interests.

However, we have to be careful regarding this expectation that Seoul will suddenly hop onto the anti-China bandwagon. There are still strong Korean corporate interests and stakeholders in China, even as we see more South Korean companies shifting operations outside of China to Southeast Asia, South Asia and elsewhere, including the United States. For large companies such as Samsung, SK or Hyundai, China is a very large market. There will be pressure from companies to not completely decouple from China. Thus the Yoon government will have to navigate between national and corporate interests.

In sum, there may be reduced trade with China relative to the past as Korean companies seek to diversify risk, but it would be unrealistic to expect a mass exodus or complete decoupling from Chinese trade.

South Korea’s Approach to the North Will Shift

BRINK: And what about North Korea — is there going to be a noticeable shift?

YEO: The clearest shift in South Korean foreign policy will be the new government’s engagement policy toward North Korea. All Korean governments, whether progressive or conservative, want inter-Korea relations to improve. How you get there, however, differs between progressives and conservatives.

The new conservative government will be much more skeptical in its approach to North Korea.

President-elect Yoon has been very clear that North Korea needs to take steps toward denuclearization before offering any sanctions relief or aid package. There are rumors that a North Korean long range missile test may occur to coincide with the anniversary of former President Kim Il-Sung’s birth on April 15. If something like that were to happen, we will see much stronger language from the Yoon government directed at North Korea and most likely a prolonged period of non-engagement.

In the meantime, nothing is happening on the engagement front while North Korea remains locked in its shell under its self-imposed pandemic border lockdown.

Where we might see some shift is if the North Koreans decide that the food or humanitarian crisis becomes unbearable. North Korea may want to begin talking again to the U.S. or South Korea. I think then we may see some opportunities for inter-Korea engagement and more flexibility from the Yoon government in how it approaches North Korea.

Related themes: CHINA INTERNATIONAL RELATIONS

Andrew Yeo

Andrew Yeo

Senior Fellow and SK-Korea Foundation Chair in Korea Studies at Brookings Institution’s Center for East Asia Policy Studies

Andrew Yeo is a senior fellow and the SK-Korea Foundation Chair in Korea Studies at Brookings Institution’s Center for East Asia Policy Studies. He is also a professor of politics at The Catholic University of America in Washington, D.C. His latest book, State, Society and Markets in North Korea is out now with Cambridge University Press.

The original article can be read at Brink’s website HERE.

How the Ukraine Conflict Is Impacting India’s Economy

India’s trade with Russia is approximately $10 billion, which is 1.3% of India’s total trade. India imports a significant amount of precious and semi-precious stones, mineral oil, boilers, nuclear reactors and fertilizers from Russia, and all of this trade is being affected, with a cascading impact on the Indian economy. After the U.S. and China, […]

How the Ukraine Conflict Is Impacting India’s Economy

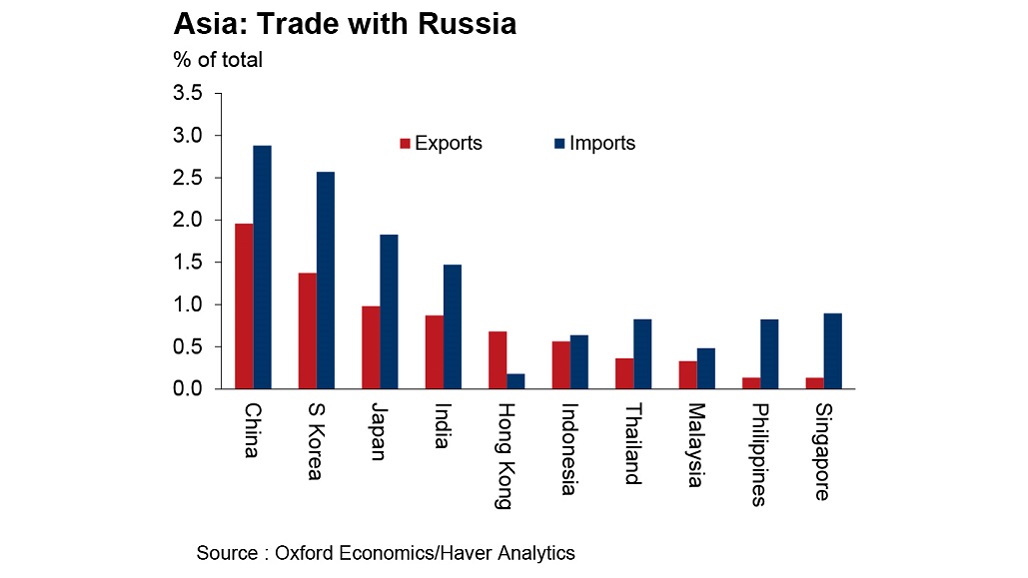

India’s trade with Russia is approximately $10 billion, which is 1.3% of India’s total trade. India imports a significant amount of precious and semi-precious stones, mineral oil, boilers, nuclear reactors and fertilizers from Russia, and all of this trade is being affected, with a cascading impact on the Indian economy.

India’s trade with Russia is approximately $10 billion, which is 1.3% of India’s total trade. India imports a significant amount of precious and semi-precious stones, mineral oil, boilers, nuclear reactors and fertilizers from Russia, and all of this trade is being affected, with a cascading impact on the Indian economy.

After the U.S. and China, India is the world’s third-largest consumer of oil, over 80% of which is imported, and oil and food prices have always haunted the Indian economy.

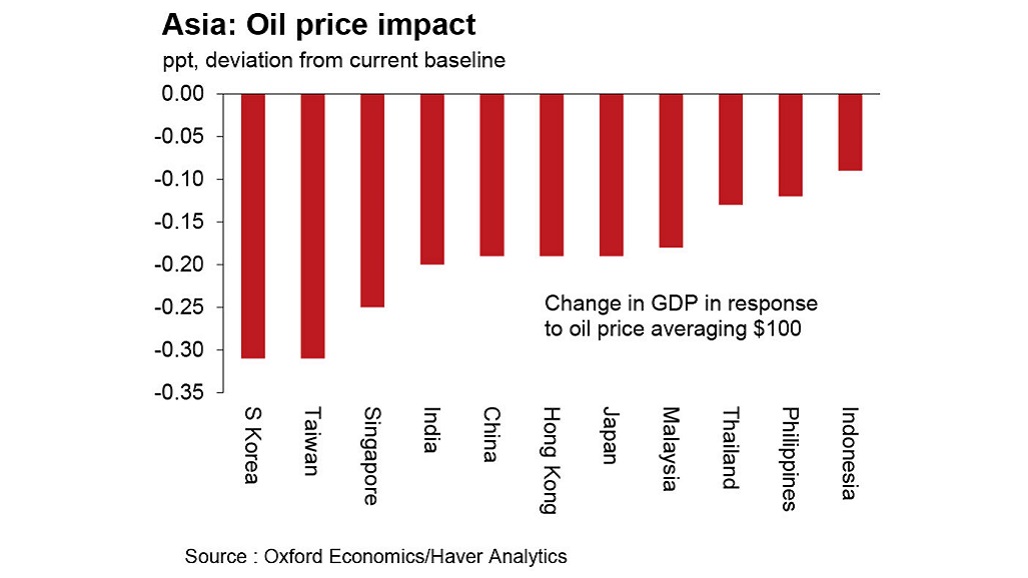

Two months into the conflict, faced with a steep upward movement of oil prices, with a projection to touch upon $140 per barrel, India’s business leaders and policymakers are seriously evaluating the impact of this crisis just as business has started to come out of the pandemic.

As the price of these commodities are reaching new highs, it opens up new markets for Indian farmers and trades.

Impact of Oil Price Hike

India imports about 2% of its oil needs and $1 billion worth of coal from Russia per year. Indian oil companies have multibillion-dollar investments in Russian oil fields, which is still relatively small compared to India’s oil requirements. On the converse side, Russian oil giant Rosneft has a controlling stake in the 20 million metric tons per annum of India’s Nayara Energy.

The most obvious impact of high oil prices is inflation. There has been a steep hike in diesel and petrol prices in the last four weeks; and LPG prices were steadily moving up even before the conflict. Fuel and power have a 13% weighting in the wholesale price index, and fuel and light have a 6.5% weighting in the consumer price index. Moreover, fuel and food prices have a cascading effect on the economy as they push up costs at every stage of agriculture and industrial production.

In its latest update, the IMF has projected a slowdown of India’s economic growth to 6.6% from 7.2% in 2022, mainly due to changes in oil price assumptions. The key assumption behind the GDP growth in the Economic Survey of India last year was that oil prices would be $70-$75 per barrel, instead of $100.

The crisis has also pushed up the price of imported fertilizers to India, particularly Urea and Potash from Russia. This threatens to increase the agriculture fertilizer subsidy bill of the government by about $1.3 billion, and the state and central governments will have to rework their budgets to accommodate these cost escalations.

If other trading partners of Russia shift to their own currency-based trade like the Indian rupee-Russian ruble arrangement, and if an alternative to bank transactions can be found, the move away from dollar-based trade and finance can accelerate.

The Silver Lining for India’s Food Exports

However, the Russia-Ukraine conflict is also creating an unlikely opportunity for select Indian agriculture exporters, especially in wheat, maize, millet and processed food.

As the Russia-Ukraine conflict unfolds, the world has been looking for Indian wheat to fill the huge shocks in the supply chains originating from Russia and Ukraine. Ukraine is one of the world’s top wheat exporters — when combined together Russia and Ukraine have a 25% share in the global market. A ban on freight from Russia also means more opportunities for Indian exporters of nuts, confectionery, fruits and pulses.

As the price of these commodities are reaching new highs, it opens up new markets for Indian farmers and trades. Until June, no fresh wheat is expected from other major markets such as Australia, Pakistan and Brazil.

Several reports say India will be able to export 10-12 million metric tons of wheat this year to markets vacated by Russia and Ukraine. Expectations of a normal monsoon season this year will further boost a growth cycle in the rural economies of India, but harnessing the opportunities also depends on how quickly the buyer-seller market is established and enhancing the freight infrastructure.

Significant Outflow in Foreign Investment

The impact of all this could have severe implications for India’s balance of payments. Due to the inelastic nature of energy demand and current difficulties in coal imports, any further increase in crude oil prices invariably leads to higher import bills for the country. If the conflict continues, this will worsen the current account deficit.

This problem is more acute in India because business is witnessing one of the most significant outflows of foreign institutional investors over the first quarter of 2022. The looming threat of a U.S. Fed rate hike makes it an extremely challenging task for the Reserve Bank of India. This will also have implications for the exchange rate. Thanks to the prudent policies and forex management strategy, the rupee did not experience any abnormal pressure.

On the other hand, if other trading partners of Russia shift to their own currency-based trade like the Indian rupee-Russian ruble arrangement, and if an alternative to bank transactions such as SWIFT can be found, the move away from dollar-based trade and finance can accelerate. These kinds of developments post the Russia-Ukraine conflict can have a far-reaching impact beyond India.

Volatility is the most likely prospect in the near future. As the country starts to recover from the pandemic-induced economic slowdown, India’s public and private sectors will need to work on resolving legacy issues of energy security, inflation and resiliency. Supply-side shocks, demand variations, the course of the conflict, and the extent of global sanctions will all impact the future of the Indian economy, while also opening some new doors for opportunity.

Related themes: INFLATION SUPPLY CHAINS TRADE

Venkatachalam Anbumozhi

Director, Research Strategy and Innovations at Economic Research Institute for ASEAN and East Asia

Venkatachalam Anbumozhi is Director, Research Strategy and Innovations at the Economic Research Institute for ASEAN and East Asia (ERIA). Previously he worked at the Asian Development Bank Institute in Tokyo. He has written books, research articles, and project reports on natural resource management, climate-friendly infrastructure design, and private-sector participation in green growth. He was a member of the APEC Expert Panel on Green Climate Finance and the ASEAN panel for promoting climate-resilient growth.

What Will India’s Post-COVID Recovery Look Like?

Can India Pull Off a Sustainable Economic Recovery?

Can a Self-Reliance Strategy Pull India Out of Recession?

The original report can be read at the Brink’s website HERE.

How Long Can China’s Economy Handle Zero COVID?

An interview with David Dollar Senior Fellow of the John L. Thornton China Center at Brookings Institution President Xi Jinping’s policy of zero tolerance toward COVID kept cases down during the first two years of the pandemic. But the infectiousness of the omicron variant is making it much harder to pull off. It’s estimated that […]

How Long Can China’s Economy Handle Zero COVID?

An interview with David Dollar

Senior Fellow of the John L. Thornton China Center at Brookings Institution

President Xi Jinping’s policy of zero tolerance toward COVID kept cases down during the first two years of the pandemic. But the infectiousness of the omicron variant is making it much harder to pull off.

President Xi Jinping’s policy of zero tolerance toward COVID kept cases down during the first two years of the pandemic. But the infectiousness of the omicron variant is making it much harder to pull off.

It’s estimated that 87 of the 100 largest cities in China are now under some kind of restricted movement. Shanghai is under an intense lockdown, severely impacting living conditions for its 25 million inhabitants.

This is starting to impact global financial markets and supply chains. BRINK spoke to David Dollar, an expert on the Chinese economy at Brookings, to assess the economic impact.

DOLLAR: It seems like the zero-tolerance policy is starting to have a negative effect on the Chinese economy. According to official data released last week, China’s economy expanded 4.8% in the first three months of this year compared to the same period last year. However, much of that growth was recorded in January and February only. There’s no question the Chinese economy has slowed down, and there are anecdotal reports about certain ports suffering big backlogs and cities that have shut down.

China’s a big country, so shutting down a couple of cities doesn’t necessarily have an overwhelming effect, but it is definitely going to be negative for China’s growth.

BRINK: Its impact will depend on how long this goes on — do you have any sense of whether the government is determined to stick to the policy?

A truck driver wearing a protective mask walks past containers at Yangshan port in Shanghai, China. Shanghai is under an intense COVID lockdown, as are an estimated 87 of the 100 largest cities in China

Photo: Yves Dean/Getty Images

DOLLAR: China has an important Communist Party congress in November, so I would be surprised if they changed policy before November. But President Xi has sent out a message to local officials to pay attention to growth, and there are examples of cities modifying their quarantine policies, for example, by moving from a three-week quarantine to one week. Or in Shenzhen, the factory that produces a lot of Apple products was allowed to keep operating. So I would say, you see some local flexibility, but they are basically sticking to their zero-tolerance policy.

BRINK: Are you seeing any sign of this rippling through global supply chains yet?

DOLLAR: The Ukraine [conflict] is having a big effect on the global economy, and the spread of COVID in China is an additional negative factor, but on a smaller scale, so far. However, the longer it goes on, the more it’s going to take away from China’s annual growth rate.

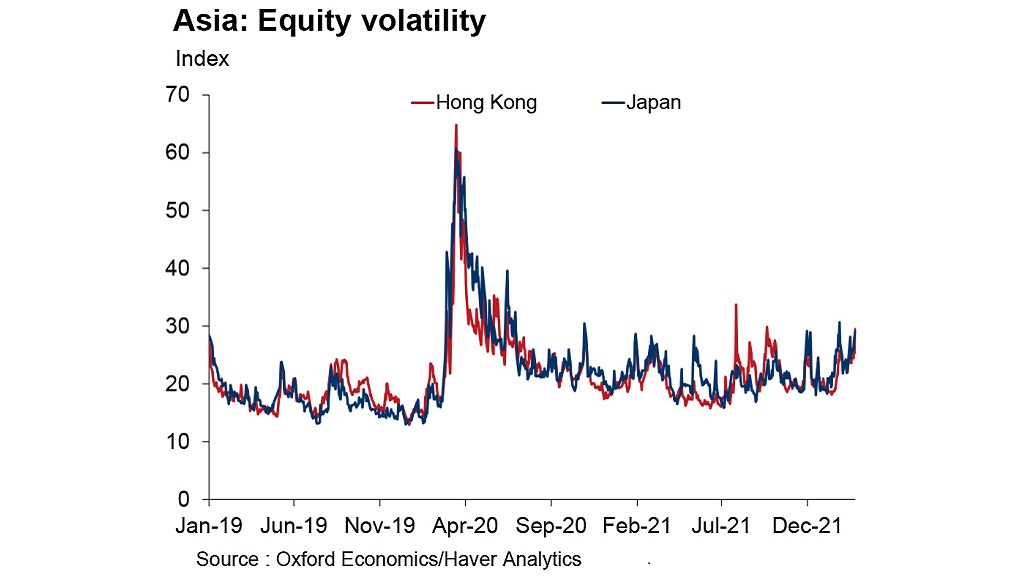

The financial markets hate the uncertainty around the Ukraine [conflict], the effect on the global economy, and what’s happening with China.

One thing about China, which we saw with the first wave of COVID, is if things shut down for a month or two, then they seem to work extra hard to recover. And that’s kind of a natural tendency, but China’s particularly good at it. Oftentimes, they get close to annual targets, they have a couple of bad months, and then they work super hard for a few months. But if the spread of cases continues throughout the year, then of course, you’re not going to be able to make up for this during 2022.

BRINK: I’ve seen some projection suggesting it could knock a point off the GDP growth. Do you think that is overly pessimistic?

DOLLAR: They set a target for the year of around 5.5% growth in GDP, and they made that decision before the Ukraine [conflict]. Frankly, even leaving aside COVID, that already seemed like a very ambitious target, given the challenges that they were already facing domestically with their real estate and the tech crackdown.

When you add in the Ukraine [conflict], the notion that COVID could take a point or more off of that 5.5 target seems realistic. The financial markets hate the uncertainty around the Ukraine [conflict], the effect on the global economy, and what’s happening with China. So it’s not surprising to see stock markets bouncing around a lot.

When it comes to Ukraine, China happens to be the poster child for a country that imports a lot of petroleum, natural gas and wheat. And the [conflict] has affected prices globally, so it doesn’t even matter where China is importing its oil and gas from — those prices have gone up very dramatically. That’s a big shock for the Chinese economy.

BRINK: How does this play with inflation if the Ukraine crisis drags on and there’s this continued zero COVID policy?

DOLLAR: Well, China has much lower consumer inflation than we do in the U.S., or even in Europe. And so, that actually puts them in a position where they can ease up their monetary policy, while we’re going to be tightening our monetary policy. So that gives them some room to stimulate the economy with both fiscal and monetary policies.

It’s a little bit of a mystery how their consumer pricing inflation has stayed so low. This latest spread of COVID has been going on long enough now that prices for a lot of services have gone down because people are not traveling or going to restaurants as much. So you’ve got price declines in services. And compared to Americans, people don’t drive nearly as much, so high gas prices don’t have as much effect on household budgets. So their inflation is quite modest and they’ve got room to stimulate.

David Dollar

David Dollar

Senior Fellow of the John L. Thornton

China Center at Brookings Institution

David Dollar is a Senior Fellow in the John L. Thornton China Center at the Brookings Institution and the host of the Brookings trade podcast, Dollar & Sense. He was the World Bank Country Director in China (2004-2009) and the U.S. Treasury representative in Beijing (2009-2013).

Will China Ever Become a Fully Developed Economy?

The original article can be viewed at the Brink’s website HERE.

Global Trade Is Battling Demand and Price Shocks

The invasion of Ukraine and renewed COVID-19 outbreaks in China will hit global trade with a double whammy in 2022: lower volumes and higher prices. We now expect trade to grow by 4.0% in volume terms in 2022 (2 percentage points lower than expected before the crisis), while trade in value terms surges by 10.9% […]

Global Trade Is Battling Demand and Price Shocks

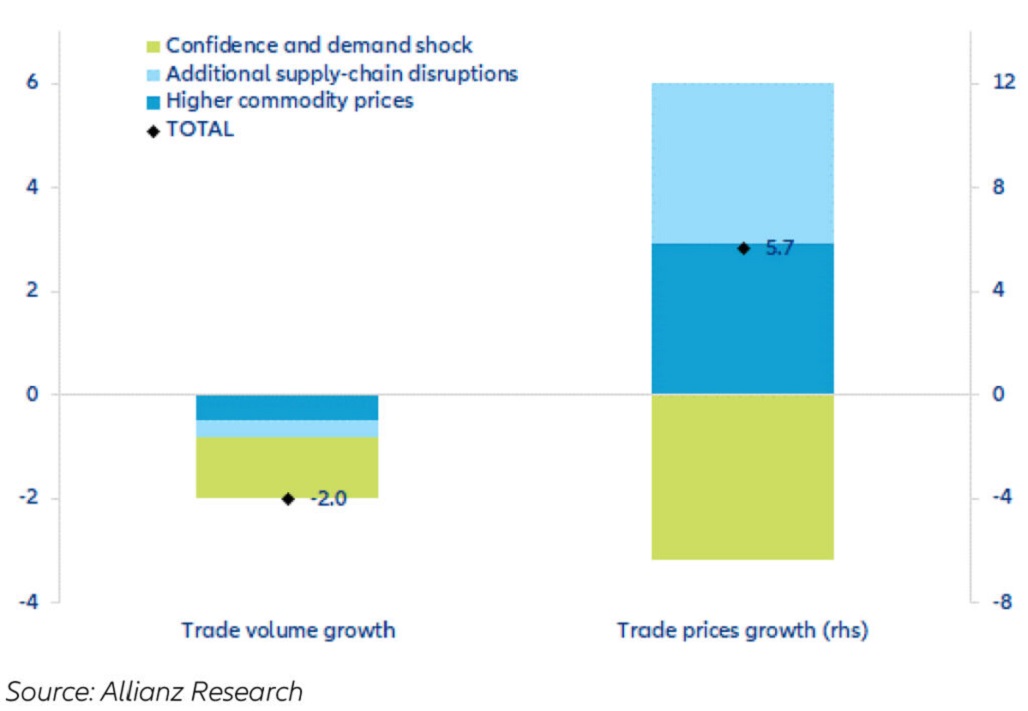

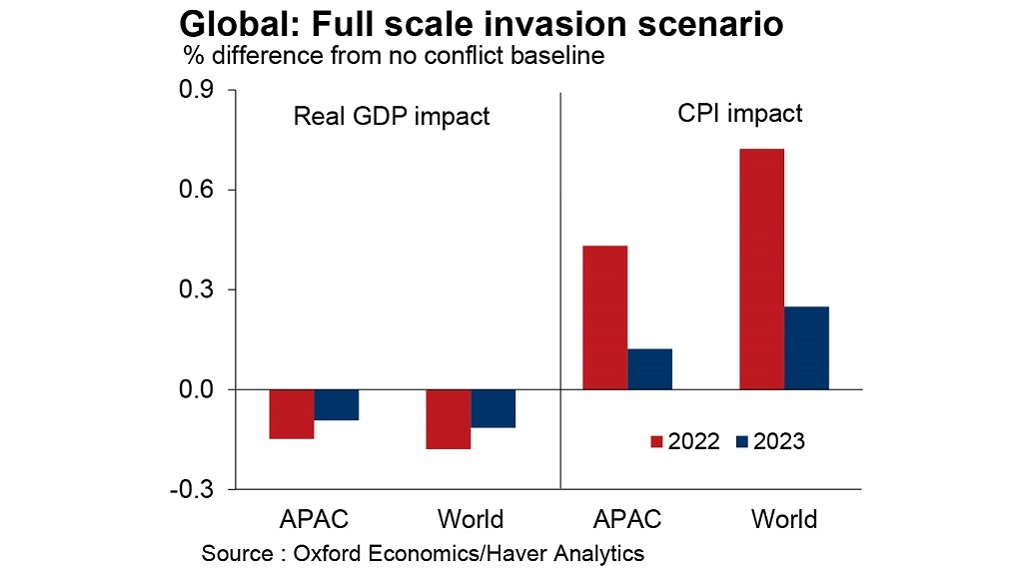

The invasion of Ukraine and renewed COVID-19 outbreaks in China will hit global trade with a double whammy in 2022: lower volumes and higher prices. We now expect trade to grow by 4.0% in volume terms in 2022 (2 percentage points lower than expected before the crisis), while trade in value terms surges by 10.9% (vs. 7.2% previously expected).

The invasion of Ukraine and renewed COVID-19 outbreaks in China will hit global trade with a double whammy in 2022: lower volumes and higher prices. We now expect trade to grow by 4.0% in volume terms in 2022 (2 percentage points lower than expected before the crisis), while trade in value terms surges by 10.9% (vs. 7.2% previously expected).

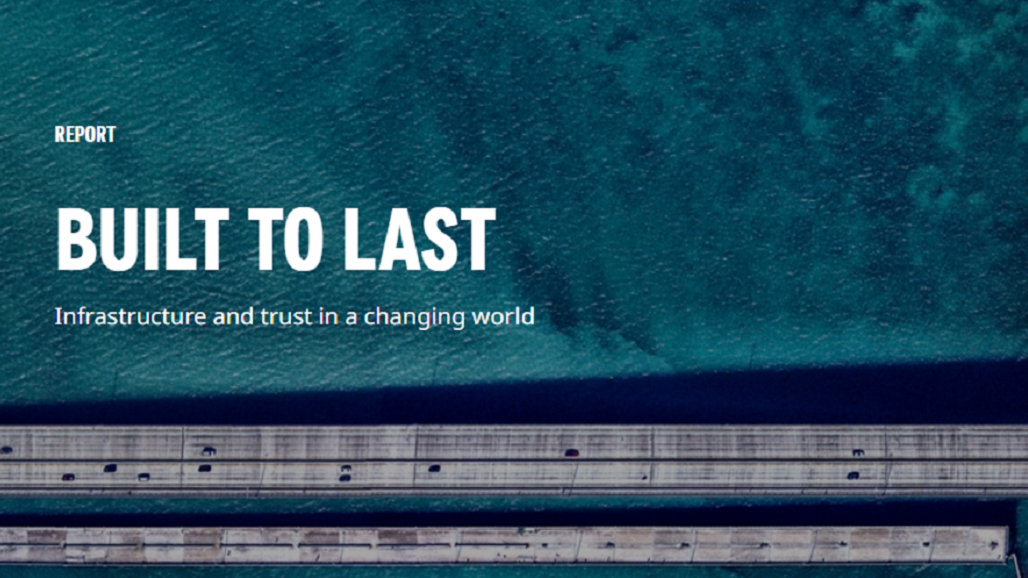

After the contraction in Q3 2021, the risk of a double-dip in global trade volume in H1 2022 has increased further – not only due to supply-chain bottlenecks, but also because of lower demand. The economic consequences of Russia’s invasion of Ukraine will slow GDP growth around the world, especially for economies in Europe. The resulting confidence and demand shock explains more than half of the downward revision in our forecast for trade growth in volume in 2022 (see Exhibit 1). Conversely, trade prices growth has been revised upwards by 5.7 percentage points, with commodity prices and additional supply chain disruptions contributing roughly equally.

Global trade will take a hit, particularly in Europe, as the conflict in Ukraine continues.

Photo: Unsplash

After the contraction in Q3 2021, the risk of a double-dip in global trade volume in H1 2022 has increased further – not only due to supply-chain bottlenecks, but also because of lower demand. The economic consequences of Russia’s invasion of Ukraine will slow GDP growth around the world, especially for economies in Europe. The resulting confidence and demand shock explains more than half of the downward revision in our forecast for trade growth in volume in 2022 (see Exhibit 1). Conversely, trade prices growth has been revised upwards by 5.7 percentage points, with commodity prices and additional supply chain disruptions contributing roughly equally.

Exhibit 1: Breakdown of 2022 trade growth forecast revisions (percentage points)

The Demand Shock

The confidence and demand shock will result in a loss of $480 billion in exports to Russia and Eurozone countries in 2022 (roughly evenly split between the two destinations), with companies in Eastern Europe the most exposed. While Russia as an end-demand market is not systemic at the global level (representing just 1.2% of global imports on average in 2015-2019), the multi-year recession it is likely to face could lead to losses in the region.

The most exposed countries are Moldova, Slovakia, Serbia, Slovenia and Czech Republic, where exports exceed 1.5% of GDP. Among the biggest Eurozone exporters, Germany and Italy are among the top 20 most exposed, with potential losses of up to 0.6% ($21 billion) and 0.5% of GDP ($90 billion) respectively, in the worst-case scenario where relationships with Russia are completely frozen.

Looking at Russia as a supplier in global and regional value-chains, Eastern Europe remains the most at risk, while a complete cut-off of relations would mean the Eurozone’s largest four economies losing up to 0.4% of their GDPs and 1.1% of their exports.

Focus on Commodities

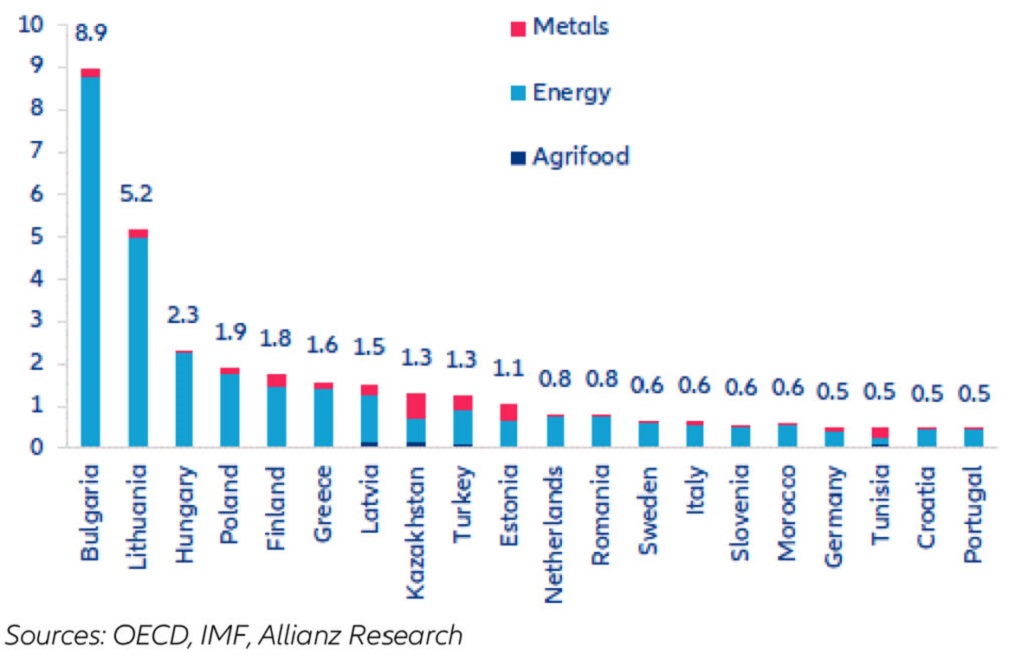

Looking at the world’s exposure to goods produced in Russia, the sectors of focus are energy (e.g., oil, gas), metals (e.g., aluminum, palladium, nickel) and agrifood (e.g., wheat, corn) as Russia respectively represents around 9%, 3% and 2% of each sector’s global exports. By looking precisely at the amount of energy, metals and agrifood inputs produced in Russia that end up in other countries’ outputs (through direct and indirect trade linkages), we find that Bulgaria (close to 9% of GDP), Lithuania (more than 5% of GDP) and Hungary (more than 2% of GDP) are the most exposed (see Exhibit 2).

Some Western and Northern European countries are also among the top 20 most exposed, including the Netherlands (0.8% of GDP), Sweden (0.6%), Italy (0.6%) and Germany (0.5%). This compares with 0.3% of Chinese GDP depending on Russian inputs, and 0.1% for the US. Looking at how much Russian value-added is used in other countries’ exports yields similar results, with Eastern European economies the most exposed, while up to 1.1% of exports from the largest four economies of the Eurozone could be at risk (compared with 0.7% for China and 0.2% for the US).

Exhibit 2: Russian energy, metals and agrifood inputs used in respective countries’ output (% of GDP), top 20 exposed in relative terms

Supply Chain Bottlenecks

Europe is thus by far the most at risk of supply-chain disruptions caused by the Russian invasion of Ukraine and ensuing sanctions. Beyond food and energy commodities, which can be easily substituted with other suppliers, metals are actually more sensitive products. Indeed, they are often part of an industrial process that has been designed to take into account the particularities of a certain supplier. As such, changing suppliers, even when possible, is not an easy task as it might require industrial adjustments. Based on the critical materials analysis from the European Commission, we observe that Russia represents over 10% of imports for about 20 metals, with key applications in transport equipment, high-end electronics (batteries, semiconductors, smartphones), construction and automotive.

To account for second-round supply-chain effects of ongoing events, value-added that needs to transit via Russia before reaching its final destination also needs to be taken into consideration, on top of that directly produced in Russia. We find that the latter has a much larger impact than the former, which is even negligible outside Europe. This confirms Russia’s limited role in global and regional supply chain logistics. Indeed, even if high-frequency data show that the number of tankers moving in the Black Sea and Baltic Sea, and the number of container vessels anchored in Russian ports, have declined since the start of the conflict, it is important to keep in mind that Russia represents just around 2-3% of the global tanker fleet and containerized trade.

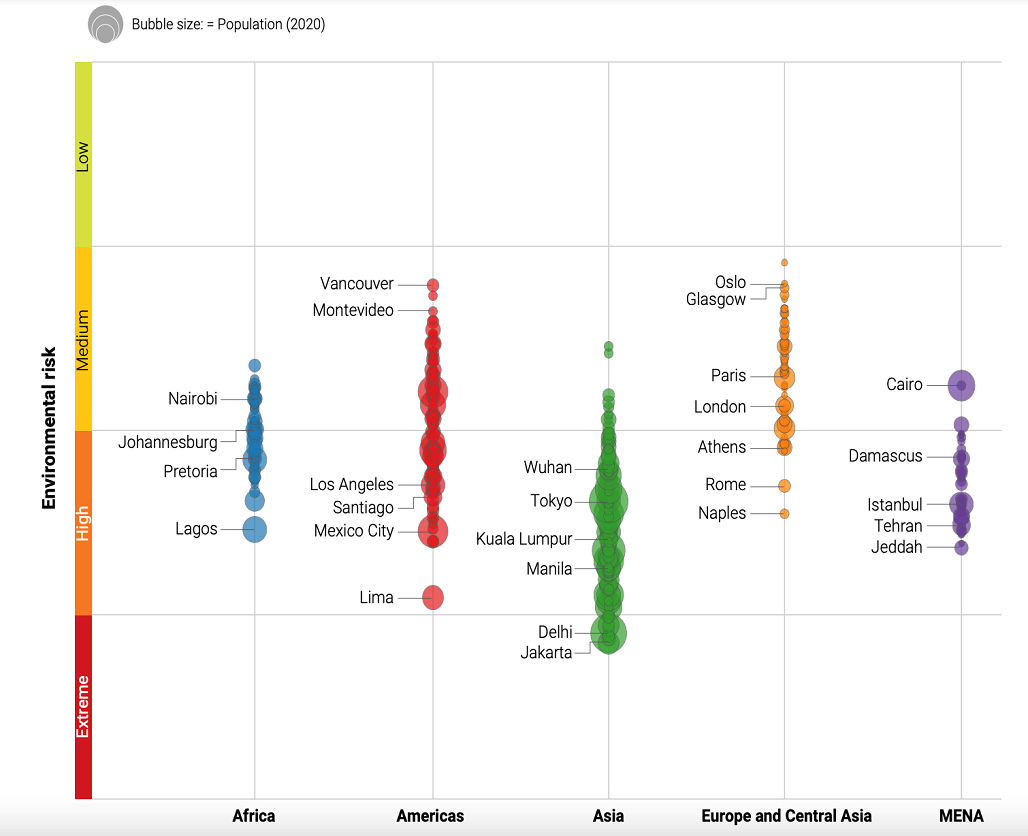

New COVID-19 outbreaks in China are the larger issue for global supply chains as the sustained zero-COVID policy is likely to keep delivery times elevated throughout 2022. Local lockdowns and more restrictions in response to rising infections in cities such as Shenzhen and Shanghai are likely to impact production and logistics in China. Data show that congestion waiting times and anchorage outside the Yantian port and the outer Pearl River Delta have risen over the past few weeks. For now, they remain below the levels seen during summer 2021, when outbreaks led to temporary port closures.

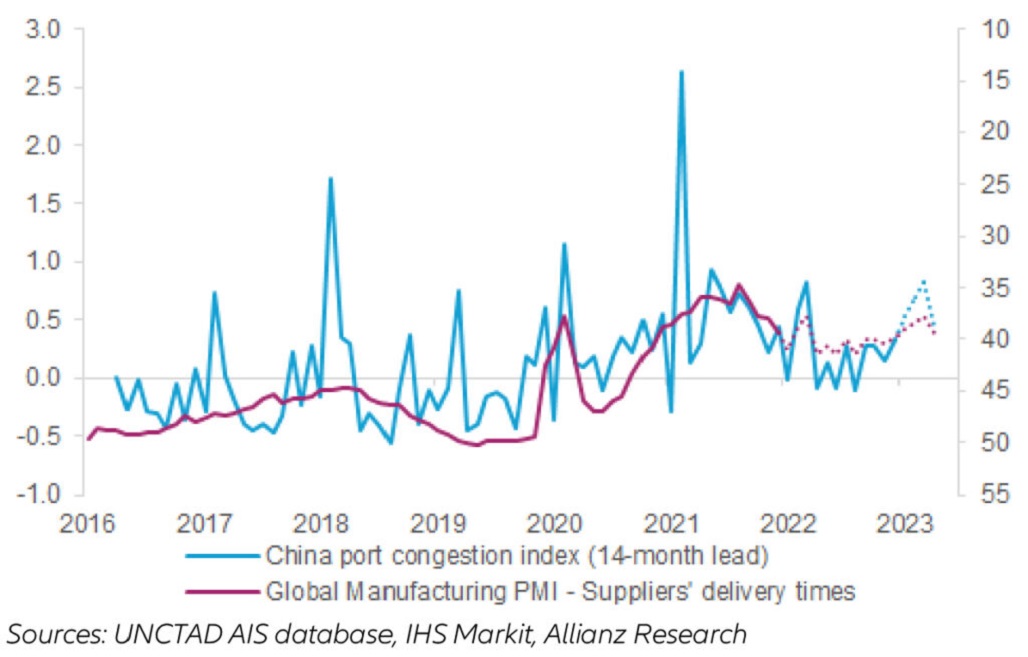

However, this new bottleneck comes at a time when the global maritime shipping industry is still fragile. A repeat of the temporary port closures in China could have ripple effects on global logistics: The historical relationship between our proprietary China port congestion index and the global manufacturing PMI suppliers’ delivery times index (see Exhibit 3) suggests that delivery times are likely to remain above the pre-pandemic average for most of 2022, and even lengthen slightly at the start of 2023 – though remaining below 2021 peaks.

Exhibit 3: China port congestion index and global manufacturing sector delivery times

Ana Boata

Ana Boata

Global Head of Economic Research at Allianz Trade

Ana Boata is the global head of Economic Research at Allianz Trade. Ana started her career in the banking sector before joining Euler Hermes in November 2012 as Eurozone economist. In 2018 she received the Best Forecaster Award for the Eurozone by Consensus Forecast. In 2019, she became head of Macroeconomic Research of Euler Hermes Group and led its thematic research on SMEs. Ana also teaches macroeconomics at the University of Paris Dauphine and Sciences Po Paris.

Françoise Huang

Françoise Huang

Senior Economist for Asia-Pacific at Allianz Trade

Françoise joined Allianz Trade in 2019 as a senior economist for Asia-Pacific. Prior to this, Françoise worked as an Economist for over five years at the equity broker Exane BNP Paribas in London. There, she was in charge of the macroeconomic analysis of the Chinese economy and Emerging Markets. She also worked on global and European topical themes. Her other work experiences include the ACPR, the French supervisor for the banking and insurance sectors.

Ano Kuhanathan

Ano Kuhanathan

Sector Advisor and Data Scientist at Allianz Trade

Ano Kuhanathan has held various positions in the financial industry in trading, research and consulting. He was the Eurozone economist at Axa Investment Managers from 2016 to 2018. Before joining Allianz Trade in 2020, he was the head of economic advisory and advanced analytics at EY Advisory. Ano regularly teaches economics, sustainable finance and applied data science at Neoma Business School.

A version of this article originally appeared in Unravel.

The original report can be read at the Brink’s website HERE.

Revolutionary Changes in Transportation Could Slow Global Warming — If They’re Done Right

Around the world, revolutionary changes are under way in transportation. More electric vehicles are on the road, people are taking advantage of sharing mobility services such as Uber and Lyft, and the rise in telework during the COVID-19 pandemic has shifted the way people think about commuting. Transportation is a growing source of the global […]

Revolutionary Changes in Transportation Could Slow Global Warming — If They’re Done Right

Around the world, revolutionary changes are under way in transportation. More electric vehicles are on the road, people are taking advantage of sharing mobility services such as Uber and Lyft, and the rise in telework during the COVID-19 pandemic has shifted the way people think about commuting.

Around the world, revolutionary changes are under way in transportation. More electric vehicles are on the road, people are taking advantage of sharing mobility services such as Uber and Lyft, and the rise in telework during the COVID-19 pandemic has shifted the way people think about commuting.

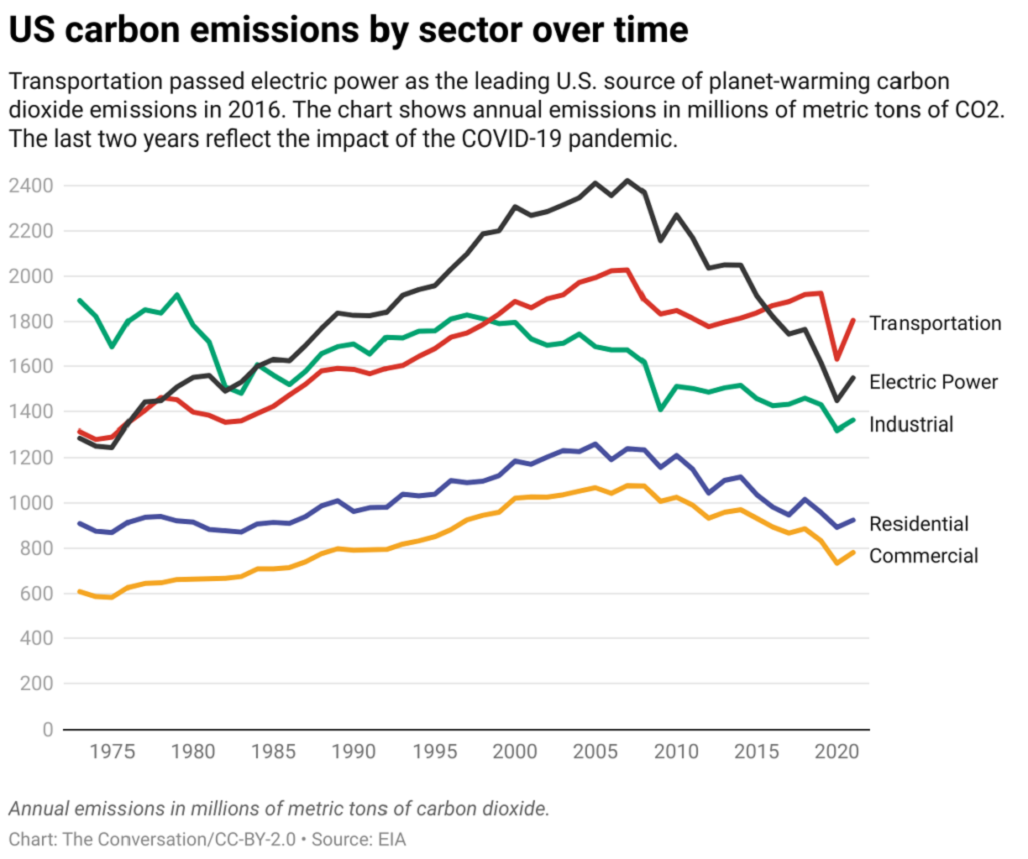

Transportation is a growing source of the global greenhouse gas emissions that are driving climate change, accounting for 23% of energy-related carbon dioxide emissions worldwide in 2019 and 29% of all greenhouse gas emissions in the U.S.

The systemic changes under way in the transportation sector could begin lowering that emissions footprint. But will they reduce emissions enough?

Electric cars are shown charging in a garage. Electric vehicles and other changes in transportation can help significantly lower the greenhouse gas emissions that cause climate change.

Photo: Unsplash

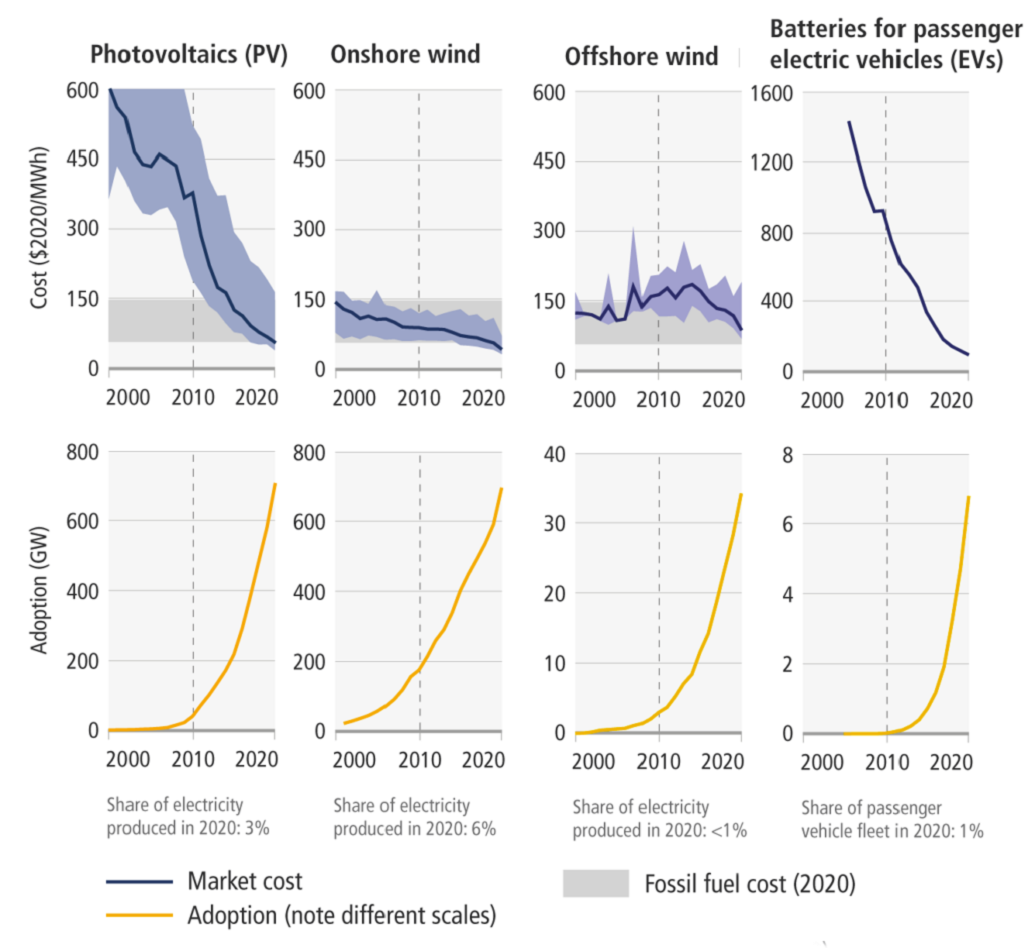

In a new report from the Intergovernmental Panel on Climate Change released April 4, 2022, scientists examined the latest research on efforts to mitigate climate change. The report concludes that falling costs for renewable energy and electric vehicle batteries, in addition to policy changes, have slowed the growth of climate change in the past decade, but that deep, immediate cuts are necessary. Emissions will have to peak by 2025 to keep global warming under 1.5 degrees Celsius (2.7 F), a Paris Agreement goal, the report says.

Source: IPCC Sixth Assessment Report

The transportation chapter, which I contributed to, homed in on transportation transformations – some just starting and others expanding – that in the most aggressive scenarios could reduce global greenhouse gas emissions from transportation by 80% to 90% of current levels by 2050. That sort of drastic reduction would require a major, rapid rethinking of how people get around globally.

The Future of EVs

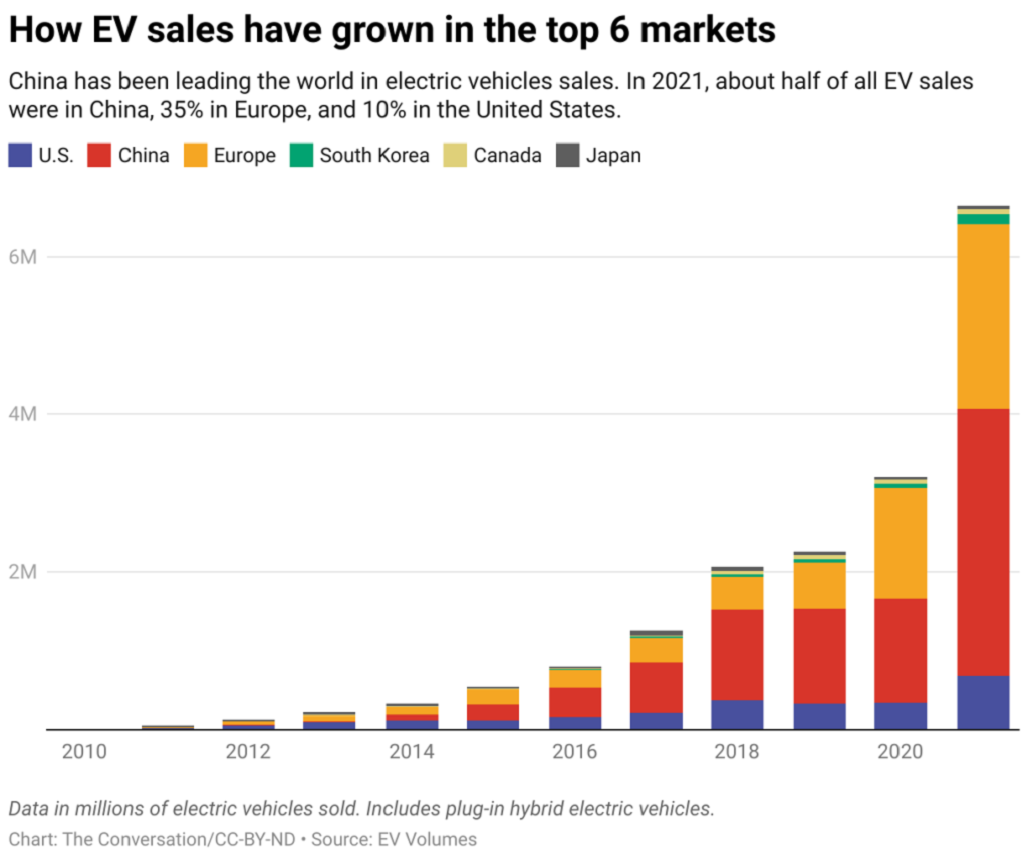

All-electric vehicles have grown dramatically since the Tesla Roadster and Nissan Leaf arrived on the market a little over a decade ago, following the popularity of hybrids.

In 2021 alone, the sales of electric passenger vehicles, including plug-in hybrids, doubled worldwide to 6.6 million, about 9% of all car sales that year.

Strong regulatory policies have encouraged the production of electric vehicles, including California’s Zero Emission Vehicle regulation, which requires automakers to produce a certain number of zero-emission vehicles based on their total vehicles sold in California; the European Union’s CO2 emissions standards for new vehicles; and China’s New Energy Vehicle policy, all of which have helped push EV adoption to where we are today.

Beyond passenger vehicles, many micro-mobility options – such as autorickshaws, scooters and bikes – as well as buses, have been electrified. As the cost of lithium-ion batteries decreases, these transportation options will become increasingly affordable and further boost sales of battery-powered vehicles that traditionally have run on fossil fuels.